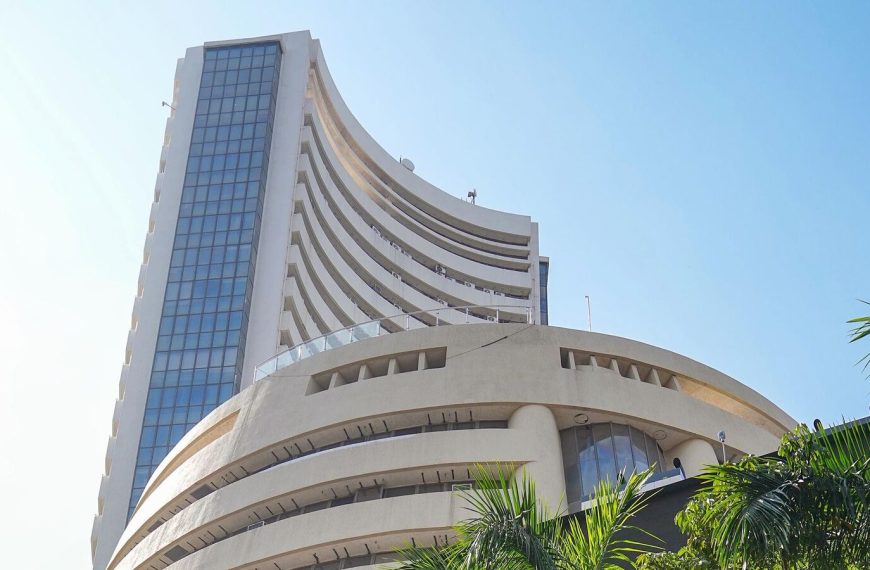

The Indian stock market is poised for a significant rebound this week following a surprising shift in tariff policies by former President Donald Trump. Strong buying activity on Friday has set the stage for a continuation of this upward trend as trading resumes on Tuesday after a long weekend honoring Dr. Bhimrao Ambedkar Jayanti. However, experts are cautioning investors to steer clear of real estate stocks amidst this rally.

Understanding the Market Dynamics

The recent quarterly results from Tata Consultancy Services (TCS) for Q4 of 2025 have raised concerns among investors. TCS has indicated that wage increases for its employees will be postponed until FY26, reflecting a cautious approach as the company navigates uncertainties in global demand due to ongoing trade tensions. This marks a critical moment for the Indian IT sector as it braces for potential slowdowns.

- Key Points from TCS Q4 Results:

- Delayed wage hikes signal uncertainty in the global economy.

- Over 600,000 employees are affected by these decisions.

- Concerns over demand due to external factors, including tariffs.

The Implications for Realty Stocks

Investment experts like Sandeep Pandey, the founder of Basav Capital, advise against investing in realty stocks at this juncture. He emphasizes that if other major IT firms like Wipro and Infosys echo TCS’s cautious outlook, rate-sensitive stocks will likely face significant downturns.

“Delays in wage increases indicate a lack of confidence in global economic stability,” Pandey noted, highlighting the precarious situation ahead for real estate investments.

What to Watch For: Upcoming Earnings Reports

Investors are advised to hold off on realty stock purchases until after Wipro and Infosys announce their Q4 results this week. These results will provide critical insights into the broader IT sector’s health and potential economic slowdowns.

- Upcoming Earnings Announcements:

- Wipro: Board meeting on April 17, 2025.

- Infosys: Financial results due on April 16, 2025.

The Broader Market Outlook

Avinash Gorakshkar, Head of Research at Profitmart Securities, warns that if Wipro and Infosys report similar signs of economic slowdown, the market could react negatively, impacting sectors like real estate, automotive, and consumer goods. Instead, he suggests investors look towards more stable sectors such as pharmaceuticals, textiles, and agriculture.

Conclusion: A Cautious Approach

As the Indian stock market gears up for a new week of trading, the cautious sentiment surrounding IT earnings could lead to a volatile environment, especially for high-risk sectors like real estate. Investors are encouraged to stay informed and consider diversifying into less sensitive industries until clearer signals emerge from the upcoming earnings reports.

With the global economy in flux, strategic investment decisions will be crucial in navigating this uncertain landscape.