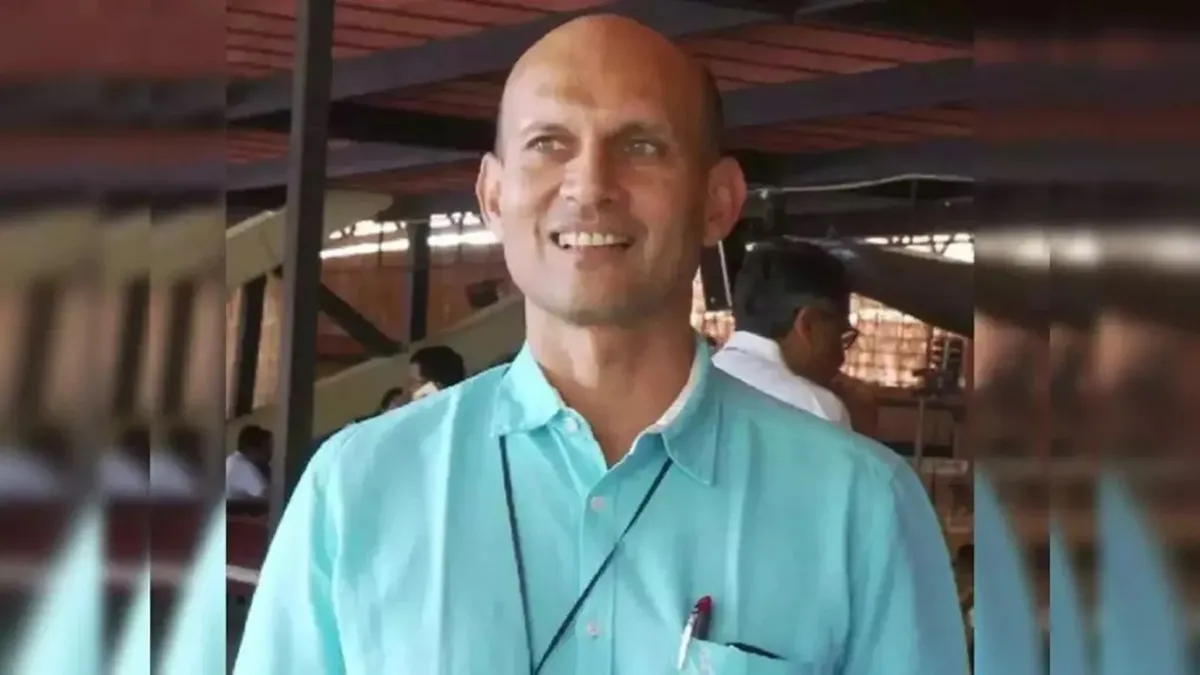

Ashish Kacholia, often dubbed the "Big Whale" of Indian investing, has made headlines once again with significant portfolio adjustments. Known for his uncanny ability to identify multibagger small-cap stocks, Kacholia’s recent moves are capturing the attention of market watchers. Currently, he manages a diverse portfolio of 41 stocks valued at approximately ₹2,427 crore (according to Trendlyne), making his investment decisions a focal point for many investors looking to emulate his success.

Insight into Kacholia’s Investment Strategies

Kacholia’s journey began in the early 1990s with Prime Securities and later at Edelweiss before founding his own brokerage, Lucky Securities, in 1995. He co-founded Hungama Digital alongside the late Rakesh Jhunjhunwala in 1999 and has been meticulously crafting his investment portfolio since 2003. Given his track record, any shifts in his holdings warrant attention, prompting many to question whether these moves signal upcoming market trends or strategic plays.

Qualitek Labs Ltd: A New Addition to Kacholia’s Portfolio

Founded in 2018, Qualitek Labs Ltd specializes in testing, inspection, and certification services across various sectors, including automotive, defense, and healthcare. With a current market capitalization of ₹292 crore, the company made its debut on the Bombay Stock Exchange (BSE) in January 2024. The funds raised from the IPO are earmarked for capital expenditure and repaying promoter borrowings.

Recently, Kacholia acquired a 5.1% stake in Qualitek, amounting to over 500,000 shares valued at ₹16 crore. This investment is intriguing, particularly as the company has experienced a 26% decline in promoter holding—from 73.35% in September 2024 to 54.19% by March 2025. During the same timeframe, Foreign Institutional Investors (FIIs) increased their stake from 0% to 1.77%.

Examining Qualitek Labs’ Financial Performance

Qualitek’s financials reveal compelling growth metrics:

- Sales Growth: Compounded annual growth rate (CAGR) of 66%, climbing from ₹6.35 crore in FY21 to ₹29.18 crore in FY24, with ₹21 crore already recorded by September 2024.

- EBITDA: Increased from ₹1.03 crore in FY21 to ₹8.07 crore in FY24, reflecting a robust 98% CAGR.

- Net Profits: A remarkable 111% CAGR, rising from ₹0.46 crore in FY21 to ₹4.31 crore in FY24, with ₹1.71 crore reported for the quarter ending September 2024.

Despite the impressive growth, concerns linger about the net profits for FY25 unless the company implements innovative strategies.

Market Performance and Future Prospects of Qualitek

When Qualitek was listed in January 2024, shares were priced at around ₹199, which surged to ₹322 by mid-April 2025—a 61% increase in less than two years. The company’s Return on Capital Employed (ROCE) stands at 17.3%, surpassing the industry median of 14%. However, the current Price-to-Earnings (P/E) ratio of 80x is significantly higher than the industry median of 24x, indicating a premium valuation.

In its recent investor presentation, Qualitek announced plans for a new minerals testing lab in Bhubaneshwar, expected to generate revenue from Q1 FY25-26. The company is also expanding its capabilities in the automotive and defense sectors.

Awfis Space Solutions Ltd: A Shift in Kacholia’s Holdings

Founded in 2014, Awfis Space Solutions has carved a niche in the flexible workspace sector, boasting a market capitalization of ₹4,658 crore. As the largest provider of flexible workspaces in India, Awfis operates across 58 micro markets in 18 cities.

Kacholia’s stake in Awfis has seen a decline from 4.83% in May 2024 to 2.51% by December 2024. The company has reported substantial sales growth—41% CAGR from ₹154 crore in FY19 to ₹849 crore in FY24. As of December 2024, Awfis has already achieved ₹868 crore in sales.

Financial Insights and Challenges for Awfis

Awfis’s EBITDA has transformed from a loss of ₹33 crore in FY19 to a profit of ₹246 crore in FY24. Despite this turnaround, net profit remains a red flag, with losses diminishing from ₹62 crore in FY19 to ₹18 crore in FY24. However, the recent quarters have shown a profit of ₹57 crore, hinting at a potential recovery.

Since its listing at ₹421 in May 2024, the stock has appreciated to ₹656 by mid-April 2025, marking a 56% increase. However, the share price remains 30% below its all-time high of ₹946.

Conclusion: A Peek into Kacholia’s Investment Philosophy

Ashish Kacholia’s recent investments in Qualitek Labs and his reductions in Awfis Space Solutions reveal the careful balance he strikes between risk and opportunity. With Qualitek’s promising growth trajectory and Awfis’s solid market position, investors are left wondering which company will ultimately prevail.

These strategic decisions highlight Kacholia’s keen insights into market dynamics, encouraging investors to stay vigilant with their portfolios. As always, it’s prudent to track these stocks for potential investment opportunities.

Disclaimer

This article is intended to provide insights and should not be considered financial advice. Investors should conduct their own research and consult with financial advisors before making investment decisions.

Suhel Khan, with over a decade of market experience, has been analyzing investment strategies of top investors in India. Please note that the author and their associates do not hold any positions in the stocks mentioned.