In recent discussions, we explored the dynamics of traditional monetary transactions and the databases that house them. We also delved into the Bitcoin blockchain, the sophisticated ledger where all Bitcoin transaction data is securely stored. In today’s digital economy, where data is often referred to as the "new oil," the management of this information is paramount. Companies that excel in data handling are often the technology giants leading the market.

Understanding Bitcoin Transactions

When initiating a Bitcoin transaction, the process begins with the "SEND" action from a wallet. This transaction information is then communicated across the network using a method known as the gossip protocol. This decentralized approach to sharing information mimics how gossip travels through social circles.

- Nodes in the Network: Each node in the network verifies the transaction’s signature for authenticity before relaying it to adjacent nodes. This efficient dissemination allows the transaction to reach all nodes rapidly.

- Mempool: Transactions are temporarily stored in a staging area called the Mempool (short for memory pool) until they are permanently recorded on the blockchain.

The Role of Miners in the Blockchain

Once a transaction is in the Mempool, it awaits processing by a block producer, commonly referred to as a miner within the Bitcoin protocol. Unlike traditional banking systems, where transactions are recorded directly into a centralized database, the decentralized nature of Bitcoin requires that transactions be validated and written to the blockchain by miners.

- Full Nodes vs. Miners: Full nodes maintain a complete copy of the blockchain and verify transactions altruistically, receiving no monetary rewards. In contrast, miners are incentivized through protocol subsidies for their efforts in adding blocks to the blockchain.

This incentive structure is crucial; without it, there would be little motivation for individuals to expend resources in maintaining the integrity of the blockchain.

The Importance of Consensus Mechanisms

In a decentralized environment, rules are necessary to determine how transactions are recorded. This is where the Nakamoto Consensus Algorithm comes into play, enabling agreement among nodes on which transactions to validate. Utilizing a proof of work mechanism, it ensures that only one miner can successfully add a block to the blockchain, thereby preventing malicious activity, such as Sybil attacks.

- Sybil Attack Prevention: The proof of work system makes it costly for anyone to create multiple identities or nodes, thereby safeguarding the network from potential threats.

Mining Rewards and the Longest Chain Rule

When a miner successfully solves the puzzle required to create a block, they receive a Coinbase transaction reward. This reward structure is critical for maintaining miner participation over time, as it encourages investment in mining resources.

- Halving Process: The Bitcoin protocol reduces the mining reward approximately every four years, a process known as "halving." For instance, the reward decreased from 6.25 bitcoins in 2020 to 3.125 bitcoins in April 2024, establishing a finite supply of 21 million bitcoins.

Bitcoin and Remittances: A Game Changer

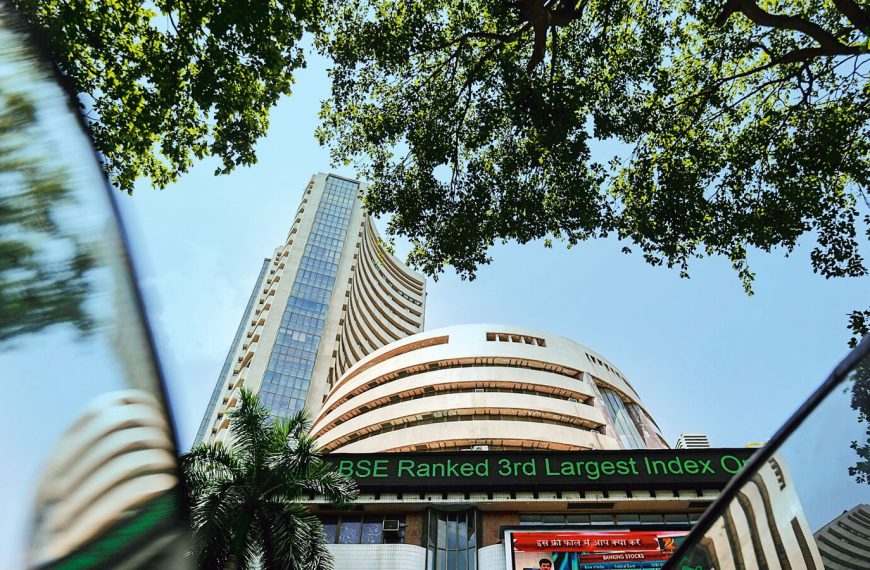

India is the world’s leading recipient of remittances, receiving over $125 billion in 2023, according to the World Bank. However, the average cost of sending money remains high, often between 6% to 8%, resulting in billions lost to intermediaries. Traditional systems can take up to 5 days to process these transactions.

In contrast, Bitcoin allows remittances to be sent quickly and at minimal cost—often under $10 for any amount, with confirmation typically occurring within 10 to 20 minutes. This efficiency can significantly benefit low-income families reliant on these funds.

Financial Inclusion Through Bitcoin

Approximately 1.4 billion adults globally remain unbanked, often due to lack of access to traditional banking infrastructure. With the widespread use of mobile phones, Bitcoin provides an opportunity for individuals to engage in financial transactions without needing a centralized authority.

Furthermore, Bitcoin serves as a safeguard for those living under authoritarian regimes, offering a means to protect assets from seizure. It empowers individuals by redistributing financial control and providing access to a secure monetary system.

Conclusion: The Philosophical Significance of Bitcoin

Bitcoin transcends being merely a currency; it represents a shift toward financial freedom and inclusion. In a world often defined by economic disparity, Bitcoin offers a lifeline, enabling individuals to store and transfer value without the constraints imposed by traditional financial systems.

For those interested in exploring the nuances of Bitcoin and its implications for the future of finance, it’s essential to consider its transformative potential in creating a more inclusive financial landscape.

Feel free to reach out to experts in the field for further insights and guidance on navigating the evolving cryptocurrency landscape.