The Indian government has taken a significant step to enhance its electronics manufacturing sector by permitting Chinese companies to participate in the Production-Linked Incentive (PLI) scheme. However, there’s a catch: these companies must collaborate with Indian firms in a joint venture to qualify for the benefits. This decision marks a new chapter in India’s strategy to bolster local manufacturing while maintaining a careful balance with foreign investments.

Joint Ventures: The Key to Eligibility

Recent reports indicate that Chinese firms can only access the PLI incentives if they establish a joint venture with an Indian partner. These ventures come with specific stipulations:

- Stake Limitation: Chinese companies must not own more than 49% of the joint venture.

- Management Control: Control of the joint venture’s operations must reside with the Indian partner.

- Technology Transfer: A crucial requirement is the transfer of technology from the Chinese firms to their Indian counterparts.

Moreover, any joint venture seeking to benefit from these incentives must secure approval under the Foreign Direct Investment (FDI) regulations.

Understanding the Electronics Component Manufacturing Scheme

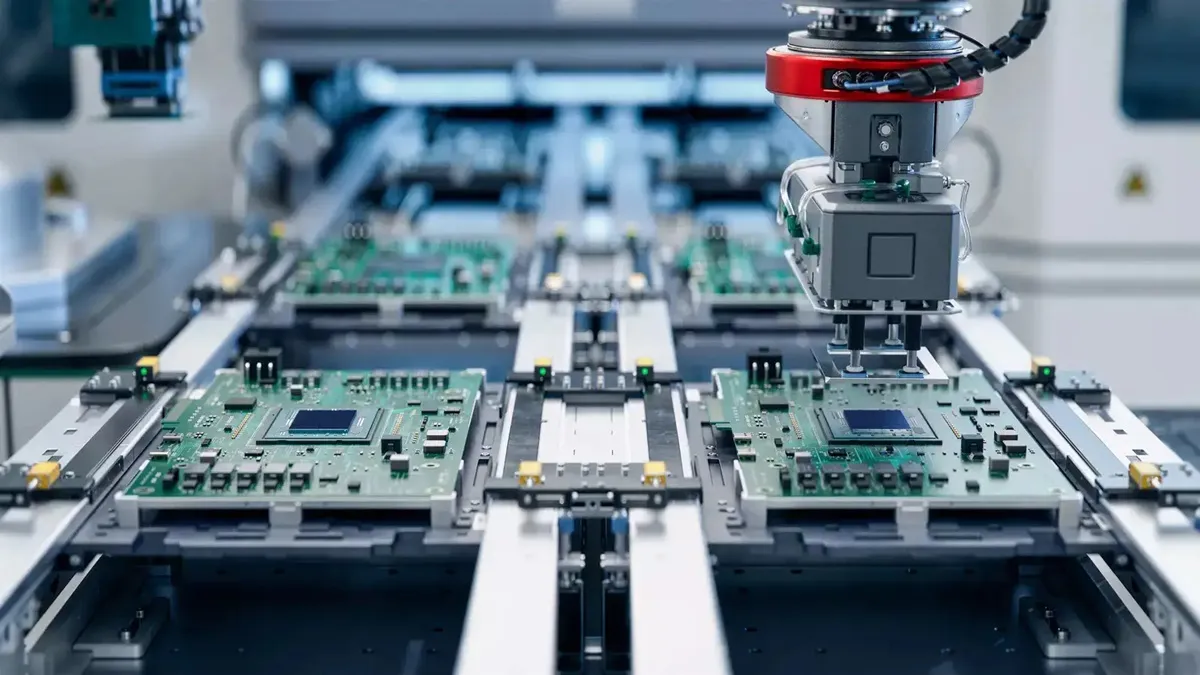

Launched on April 8, the Electronics Component Manufacturing Scheme (ECMS) aims to elevate India’s domestic production of electronic components. This initiative encompasses a wide array of products, including:

- Mobile and IT hardware

- Electro-mechanical devices

- Display modules

- Camera modules

With a budget allocation of Rs 22,919 crore, the scheme is poised to attract a substantial investment of Rs 59,000 crore from both domestic and foreign players, ultimately generating around 91,000 jobs.

Growing Interest from Indian Corporations

Several key players in the Indian electronics market are already planning substantial investments in the component manufacturing sector. Notable companies include:

- Dixon Technologies: One of India’s largest electronics manufacturers, Dixon is gearing up to invest significantly in this area.

- Tata Group: The conglomerate has shown keen interest, planning to infuse Rs 2,000 crores into electronics component production.

This initiative not only emphasizes India’s commitment to becoming a manufacturing hub but also reflects a strategic approach to engaging with foreign entities while safeguarding local interests.

In conclusion, as the Indian government opens its doors to Chinese investment under stringent conditions, it seeks to foster a more self-reliant electronics industry. This move could potentially reshape the landscape of electronics manufacturing in India, paving the way for innovation and growth.