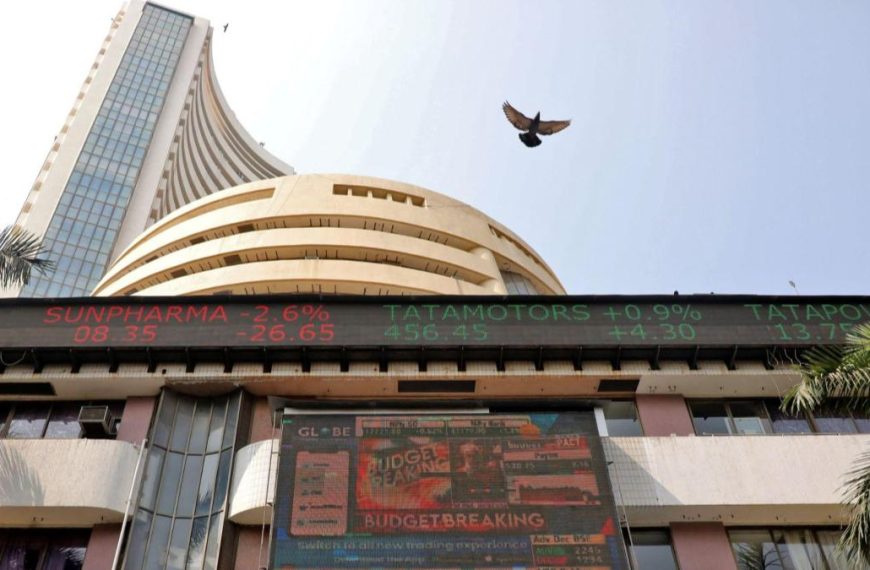

On Friday, April 11, the Indian stock market is poised for a robust opening, fueled by a significant easing of trade anxieties. This surge in market sentiment follows U.S. President Donald Trump’s announcement of a 90-day suspension on reciprocal tariffs, despite escalating tariffs on Chinese imports to an eye-popping 125 percent. The existing 10 percent baseline tariff on other imports will still apply, but the overall economic outlook appears more optimistic.

Global Trends Impact Indian Markets

With the Indian market closed on Thursday, April 10 for Mahavir Jayanti, traders are eager to see how global trends will influence local stocks. Trump’s tariff announcement has provided a much-needed boost to international markets, with notable gains across the board.

- Wall Street saw the Nasdaq surge by 12.16 percent, while the S&P 500 and Dow Jones gained 9.52 percent and 7.87 percent, respectively.

- In Europe, the FTSE, CAC, and DAX indices all experienced gains of up to 6 percent.

- Asian markets mirrored this positivity, with the Nikkei rising by 8.36 percent and the Taiwan Weighted index increasing by 8.46 percent.

The Trump Effect on Market Sentiment

Pranay Aggarwal, CEO of Stoxkart, emphasized that the pause on tariffs, excluding those on China, aims to reduce global economic stress. This decision has been welcomed by investors worldwide, improving sentiment significantly. However, he cautions that sectors like pharmaceuticals and seafood exports could still face challenges amidst these policy shifts.

- Investor Insight: Ongoing trade negotiations and developments in affected sectors will be crucial for navigating these uncertain waters.

Economic Factors Contributing to Market Optimism

In addition to the tariff news, the Indian economy is showing positive signs that could bolster market confidence. The Reserve Bank of India (RBI) recently announced a 25 basis point rate cut and revised inflation projections for FY26. The central bank now expects inflation to hover around 4 percent, down from 4.2 percent previously, although it has slightly adjusted its GDP growth forecast from 6.7 percent to 6.5 percent.

- Future Rate Cuts: Given the moderating inflation and growth, analysts anticipate that the RBI may implement three to four additional rate cuts in this cycle.

- Monsoon Forecast: A predicted normal monsoon from June to September could further support agricultural sectors and overall economic stability.

Indian Market Resilience Amid Global Challenges

Despite a 0.61 percent decline in the Nifty 50 on Wednesday, the Indian market has demonstrated resilience, outperforming many global counterparts.

- Export Dependency: It’s worth noting that Indian merchandise exports to the U.S. represent only 2-2.5 percent of GDP, suggesting that the economy can withstand some impacts from global trade slowdowns.

- Crisil’s Perspective: Analysts from Crisil believe that while the Indian economy is not immune to global disruptions, a strong balance sheet can help cushion the effects.

In conclusion, although Trump’s tariffs introduce a layer of uncertainty, the combination of favorable economic indicators and global market trends paints a cautiously optimistic picture for the Indian stock market. Investors are advised to keep a close watch on evolving trade negotiations and sector-specific news to navigate this dynamic environment effectively.