Investing in the equity market can feel like navigating a rollercoaster, filled with ups and downs that test even the most seasoned investors. While the potential for long-term rewards is enticing, particularly over a five-year horizon, the short-term volatility can be unsettling, especially for those relying on these investments for regular income. This volatility poses a significant challenge, particularly for individuals whose retirement savings are tied to the market’s whims.

However, investing in robust companies that consistently distribute dividends offers a beacon of stability amidst the chaos. This article highlights two well-established firms known for their sound fundamentals and reliable dividend payouts, making them attractive options for investors seeking a steady income stream.

Castrol India: A Leader in Lubricants

Castrol India, a subsidiary of the renowned British Petroleum Group, has carved out a significant niche in the automotive and industrial lubricant sectors. With a strong brand presence, Castrol India is involved in manufacturing and marketing lubricants across 12 industries, offering 45 different brands and nearly 600 variants. Its impressive sales figures—approximately 7 liters sold every second—underscore its dominance in the lubricant market.

Strong Market Position

- Market Share:

- 38.7% in four-wheelers

- 26% in two-wheelers

- 21.3% in commercial vehicles

Castrol India follows a fiscal year from January to December and has consistently rewarded its shareholders. Over the years, its dividend per share has risen significantly, from ₹5.5 in FY20 to ₹13 in FY24, resulting in a current dividend yield of 6.5% at a share price of ₹200.

Financial Growth

The company’s revenue has seen a compound annual growth rate (CAGR) of 16%, reaching ₹53.6 billion from FY20 to FY24, while its profit after tax has also surged, showcasing a CAGR of 12% to ₹9.3 billion. This growth can be attributed to a solid margin exceeding 20%.

In FY24 alone, revenue increased by 6%, and net profit grew by 7%, driven by robust sales volumes and an impressive margin of 24%. Factors contributing to these positive results include expanding distribution networks in rural areas and launching products tailored to original equipment manufacturers.

Future Outlook

Looking to the future, Castrol India’s management is focused on enhancing brand visibility, expanding its distribution channels, and introducing new products. The company anticipates sustained demand for lubricants, projecting growth to continue through the late 2030s and early 2040s. Although there is concern about the gradual adoption of electric vehicles (EVs), Castrol aims to maintain industry average growth rates of 4-5%, targeting an EBITDA margin of 22-25% by CY25.

In the broader context, India ranks as the third-largest lubricant market globally, accounting for 10% of worldwide demand and 21% of the Asia-Pacific market. The automotive and industrial sectors are significant drivers of this demand.

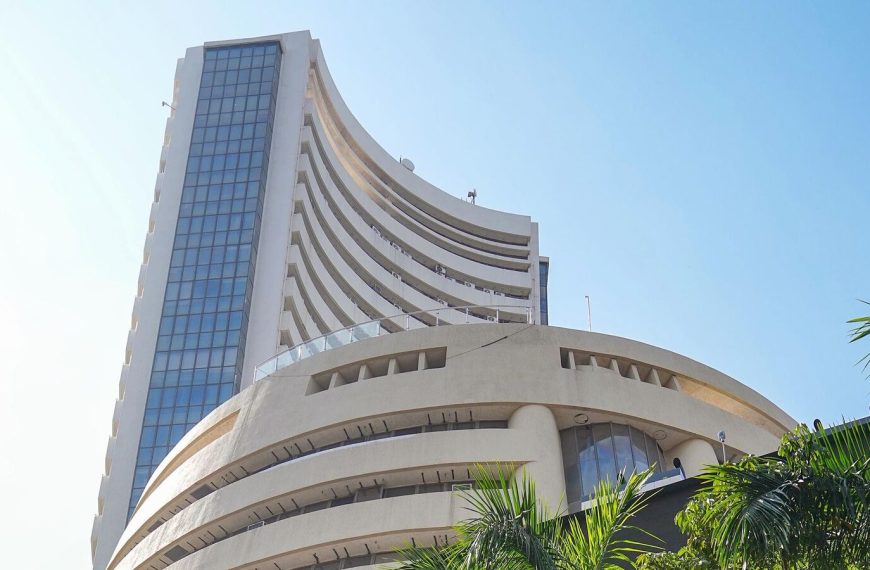

Indian Oil Corporation: A Maharatna Powerhouse

Indian Oil Corporation, recognized as a Maharatna Public Sector Undertaking, stands as India’s largest oil refining and marketing entity. The company is deeply integrated across the hydrocarbon value chain, from exploration and production to refining and marketing petroleum products.

Major Refining Capacity

- Total Refining Capacity: 80.75 million metric tonnes per annum

- Refineries: 11, contributing 31% of India’s total refining capacity

- Pipeline Network: 20,000 km

- Retail Outlets: 39,000

- LPG Distributors: 12,908

Indian Oil is renowned for its consistent dividend payments, boasting a history of rewarding shareholders. In FY24, the company increased its dividend to ₹12, resulting in a yield of 9% based on the current share price of ₹133.

Operational Efficiency

The company has maintained impressive capacity utilization rates above 95% over the last three financial years, reflecting strong operational efficiency. Its revenue has expanded at an 11% CAGR, reaching ₹8.67 trillion, while net profit saw remarkable growth of 134% CAGR, totaling ₹396 billion.

Despite fluctuations in oil prices affecting profit margins, Indian Oil remains resilient. The company’s projected capital expenditure over the next 2-3 years is set to range between ₹300-350 billion annually, primarily aimed at expanding refinery capacity and enhancing its petrochemical and renewable energy capabilities.

Market Challenges and Future Plans

Indian Oil faces the ongoing challenge of crude oil price volatility, but it is strategically investing in projects worth approximately ₹1.5 trillion over the next five years. This investment strategy is designed to bolster its refining capacity and diversify into renewable energy sectors.

Conclusion: A Steady Choice for Income-Driven Investors

For those in search of reliable income, Castrol India and Indian Oil Corporation emerge as prominent choices, thanks to their consistent dividend distributions and robust operational frameworks. While market fluctuations pose inherent risks, both firms demonstrate a steadfast commitment to their shareholders, making them worthy considerations for any dividend-focused investment strategy.

However, it is essential to remember that dividend payouts can be influenced by market stability and company performance. Therefore, investors should not view these stocks as replacements for fixed-income options such as bonds or deposits. As always, it’s advisable to consult with a financial advisor before making any investment decisions.

By keeping an eye on the market landscape and understanding the dynamics at play, investors can navigate their financial journeys with confidence.