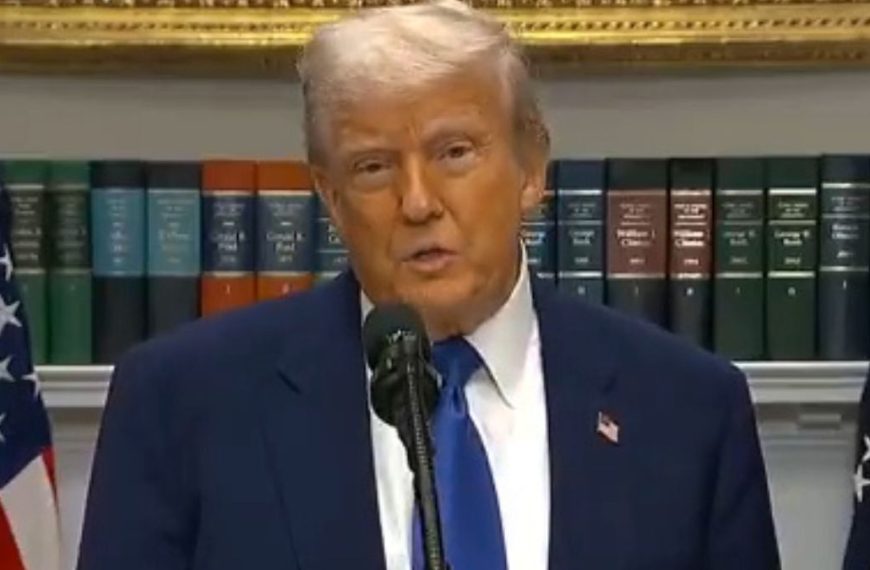

The pharmaceutical industry is bracing for potential upheaval following a significant executive order signed by US President Donald Trump on May 12. This order mandates that American drug manufacturers adjust their pricing to align with those in developing nations, where medications often cost significantly less—sometimes two to five times lower. Japanese investment firm Nomura has indicated that this development could introduce considerable uncertainty in the sector, characterizing the order as detrimental to specialty drugs while presenting a mixed outlook for generics.

Trump’s Executive Order: Implications for the Pharmaceutical Sector

Following the announcement, the pharmaceutical market reacted with concern. Nomura warned that if the order is enacted, it could severely impact both revenues and earnings for many companies. Furthermore, it might deter Indian pharma firms from pursuing specialty drug opportunities in the US market.

- Key Concerns:

- Potential revenue decline for US pharmaceutical companies.

- Discouragement of investment in specialty drugs by Indian companies.

Sun Pharma: A Company Under Pressure

Among the firms that might face significant challenges is Sun Pharma, which has a substantial presence in the US. Nomura estimates that Sun Pharma’s specialty sales could reach $1,036 million by fiscal year 2025. The company’s leading product, Ilumya, is projected to generate $570 million in US sales, largely through Medicare Part B. Alarmingly, Ilumya’s price in the US is roughly four times higher than in other developed markets, exposing it to the risks associated with price alignment efforts.

- Financial Impact:

- Ilumya’s pricing vulnerability could threaten revenue streams.

- US government programs like Medicare and Medicaid, which account for 30-40% of prescriptions, are likely to be influenced by these pricing changes.

Generics Market: Navigating a Complex Landscape

The consequences of the executive order also extend to the generics sector, presenting a mixed bag of outcomes. Nomura highlighted that lower drug prices in the US could shrink the market for generics and biosimilars, especially for complex generics, which have limited competition and only modestly lower prices than their branded counterparts.

However, the impact on commoditized generics may be minimal since their prices are already reduced due to market competition. Nomura explained that these generics are sold at significant discounts to brand-name drugs, suggesting that their pricing structures are unlikely to be further affected.

- Key Insights:

- Complex generics may see reduced market viability.

- Commoditized generics are less likely to experience price changes due to existing competition.

Interestingly, the order’s potential to weaken the influence of trade channels could yield some positive outcomes. If measures are implemented to reduce the trade’s bargaining power, it could facilitate better pricing for biosimilars and enhance market penetration.

Overview of the Executive Order’s Provisions

President Trump’s new directive requires the administration to set specific price levels for pharmaceutical products within 30 days. Non-compliance could lead to measures like easing drug imports and restricting exports. Additionally, the order advocates for direct-to-consumer sales, enabling patients to bypass intermediaries in the supply chain.

Trump expressed his frustration with the current pricing disparity, stating, “Our citizens pay massively higher prices than other nations for the same exact pill, from the same factory.” He emphasized the need for reform to prevent American consumers from subsidizing lower drug prices abroad.

While the recent executive order suggests a strong policy approach, Nomura cautions that past similar initiatives faced significant legal challenges and were halted by US courts. As the industry watches closely, the practical ramifications of this order remain to be seen.