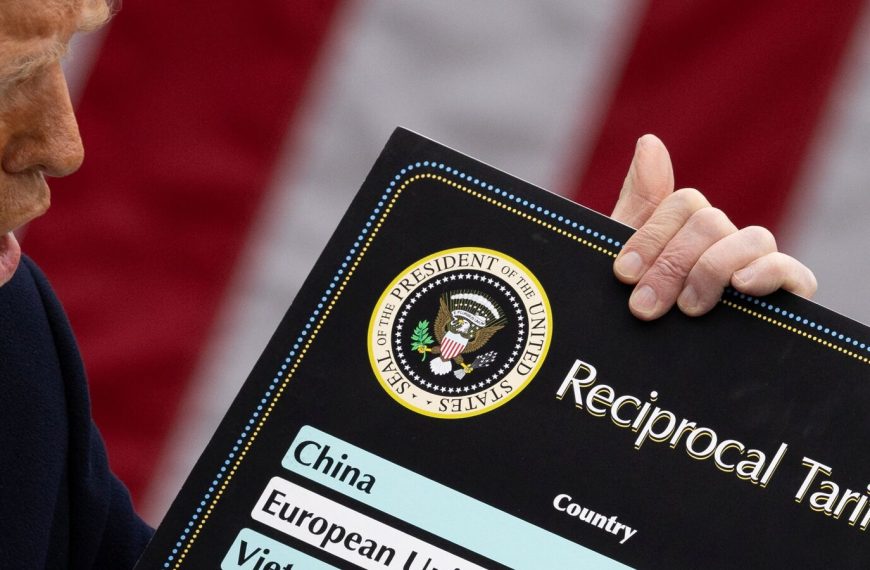

President Donald Trump has activated a sweeping 25% tariff on imports of steel and aluminum, marking a significant escalation in the ongoing global trade conflict. As this policy came into effect on Wednesday, the European Union swiftly responded, indicating that this new phase of the trade war could have serious implications for international relations and the economy.

Immediate Global Reactions

The tariffs, which apply universally without exemptions, were implemented following a tumultuous day at the White House. During this time, Trump even considered doubling tariffs on Canada, only to backtrack when Ontario agreed to withdraw plans for a surcharge on electricity exports to the U.S. Despite the potential for economic turmoil, Trump downplayed fears of a recession as U.S. markets reacted negatively to the news.

- Major Asian countries, including South Korea, Taiwan, Japan, and Australia, refrained from retaliation for now.

- The United Kingdom intends to prioritize negotiations for a broader economic agreement.

- China, while not directly targeted, summoned representatives from Walmart Inc. to discuss rising costs linked to the tariffs.

EU’s Strong Countermeasures

The European Commission reacted decisively, promising "swift and proportionate countermeasures" against U.S. imports. This includes reinstating measures from previous years and introducing a new list of products subject to tariffs. The EU’s counteractions are projected to impact U.S. exports worth approximately €26 billion, effectively matching the scope of the U.S. tariffs.

European Commission President Ursula von der Leyen expressed her discontent, stating, “We deeply regret this measure. Tariffs are taxes. They harm businesses and hurt consumers even more.”

Economic Implications for the U.S.

Trump’s aggressive tariff strategy comes at a precarious time during his second term, as it aims to reshape the U.S. economy into a global manufacturing powerhouse. However, this approach has unnerved financial markets and raised concerns among consumers still grappling with inflation from the pandemic.

Interestingly, the market’s initial reaction showed some resilience. For instance:

- Aluminum prices increased by 0.3% on the London Metal Exchange.

- Hot-rolled steel products saw a 0.4% uptick on the Shanghai Futures Exchange.

Despite lobbying efforts from U.S. stakeholders, including Alcoa Corp., which argued that the tariffs could jeopardize tens of thousands of jobs, Trump proceeded with his plan. Supporters within the domestic industry argue that such protectionist measures could ultimately benefit U.S. producers and bring jobs back home.

Tariffs and Their Broader Implications

The tariffs are part of a larger agenda to establish protective barriers around the U.S. economy, a move that Trump claims is essential to rectify a global trading system he feels is unfairly disadvantaging the United States. However, his inconsistent approach has led to skepticism regarding his commitment to these duties.

In recent developments, Trump imposed tariffs on Canada and Mexico related to illegal drugs and migration, only to announce temporary exemptions shortly after. His renewed focus on steel and aluminum tariffs prohibits exemptions, affecting around $150 billion worth of imported consumer goods, according to Global Trade Alert.

Concerns Among Industry Leaders

Leading U.S. steel manufacturers, including Nucor Corp. and United States Steel Corp., have cautioned Trump to avoid exemptions, pointing out that previous carveouts led to an influx of imports that hurt domestic prices and profits. Before such exemptions, tariffs had successfully elevated prices and reduced imports, but the industry’s current outlook remains uncertain.

The aluminum sector faces additional challenges due to its global nature, with significant production occurring in Canada. Executives from Alcoa have warned that a 25% tariff could lead to the loss of 20,000 jobs directly in the U.S. aluminum industry, along with an estimated 80,000 indirect jobs.

Future Outlook

As the trade landscape evolves, economists expect that these tariffs could raise costs for various domestic industries reliant on foreign steel and aluminum. This may lead to higher prices for consumers in sectors such as automotive and appliances.

Advocates of Trump’s tariff strategy argue that this initiative could stimulate domestic manufacturing. They contend that while there may be short-term pain for consumers, long-term benefits will emerge from enhanced job creation and economic stability.

Internationally, reactions have been mixed. Australian Prime Minister Anthony Albanese criticized the actions as "entirely unjustified" and detrimental to the economic ties shared between nations. The unfolding scenario highlights the growing tensions within global trade as countries navigate the complexities of tariffs and economic policy.

The unfolding trade conflict continues to pose challenges and opportunities for businesses and economies worldwide. As these developments progress, keeping a close eye on the evolving landscape will be essential for stakeholders across the board.