On a recent Friday, President Donald Trump urged Federal Reserve Chair Jerome Powell to implement interest rate cuts, citing a decline in energy prices, interest rates, and inflation. These comments emerged amid significant turmoil in the U.S. markets, following Trump’s sweeping tariff announcements aimed at benefiting American interests. Despite his previous conflicts with Powell, Trump has consistently advocated for a reduction in rates from the central bank leader he once appointed.

Trump’s Call for Action on Interest Rates

In a post on Truth Social, Trump emphasized that this moment is ideal for the Federal Reserve to lower interest rates, currently set between 4.25% and 4.50%. He stated, “This would be a PERFECT time for Fed Chairman Jerome Powell to cut Interest Rates. He is always ‘late,’ but he could now change his image, and quickly.”

- Key points from Trump’s post:

- Energy prices are decreasing.

- Inflation levels are lower.

- Prices for essentials, like eggs, have dropped by 69%.

- Employment figures are on the rise.

Trump urged Powell to stop “playing politics” and take decisive action to aid the economy.

Market Reactions and Economic Implications

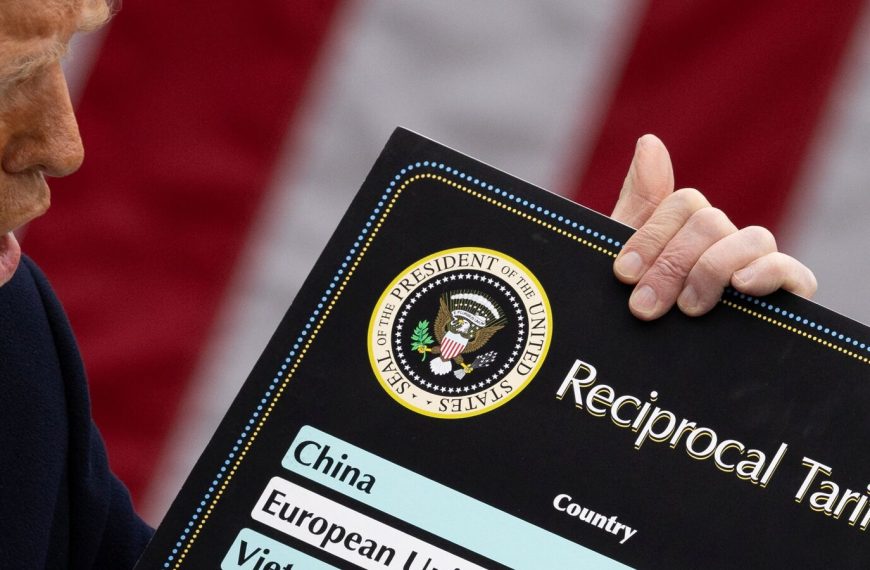

Trump’s remarks surfaced shortly after he announced tariffs affecting nearly all countries, an action that many economists warn could trigger a global economic downturn. Consequently, markets have reacted negatively, erasing trillions in investor wealth.

Jerome Powell responded to the situation by expressing his surprise at the magnitude of the tariffs, stating they could lead to a temporary rise in inflation. He cautioned that the long-term effects might be more enduring than anticipated. “Our obligation is to keep longer-term inflation expectations well anchored,” said Powell, highlighting the Federal Reserve’s mission to prevent short-term price spikes from becoming chronic inflation issues.

Powell’s Cautious Approach

During a recent conference, Powell reiterated that the Federal Reserve is not rushing to alter interest rates. He mentioned, “Our macroeconomists are working diligently to digest this week’s news and incorporate it into their forecasts.”

- Key takeaways from Powell’s remarks:

- The Fed is assessing the need for policy changes.

- Immediate action is not perceived as necessary.

- The appropriate monetary path remains uncertain.

Powell indicated that a careful approach is required to evaluate the evolving economic landscape before any decisions are made.

The Future of Interest Rates

Given Powell’s focus on inflation, it seems unlikely that he will comply with Trump’s request for immediate rate cuts. This may disappoint Wall Street investors, who anticipated several rate reductions this year, particularly in light of the recent tariff announcements. Economists believe that these tariffs could weaken economic growth, impact hiring, and increase prices, leaving the Fed with a challenging decision to either cut rates to stimulate the economy or maintain current rates to combat inflation.

The Federal Reserve is set to convene in the first week of May, when more clarity on the economic situation may emerge. As we await this crucial meeting, the tension between Trump’s policy aspirations and Powell’s cautious strategy continues to shape the economic narrative in the U.S.