India’s stock market experienced a turbulent start to the week, with metal stocks bearing the brunt of the decline. On Monday, the Nifty Metal Index plummeted by more than 7.5%, driven by escalating concerns regarding a potential global economic slowdown, particularly as tensions from the US-China trade conflict intensify.

What Caused the Market Drop?

The recent escalation in tariffs is at the heart of the issue. The United States imposed a substantial 26% tariff on imports from India, prompting China to respond with its own 34% duties on American products. Compounding these tensions, China has enacted export restrictions on crucial rare earth metals, targeting US tech and defense sectors.

This escalating tit-for-tat dispute between the two economic giants has reverberated throughout global markets. Metal stocks, which are particularly sensitive to international demand fluctuations, have faced significant pressure.

Metal Stocks Plummet Amid Rising Trade Tensions

On Monday, the Nifty Metal Index fell sharply, concluding the day at 7,810.45, with all 15 stocks in the index experiencing losses. The decline can be attributed to rising global trade tensions and increasing recession fears in the United States. Leading the downward trend was Lloyds Metals and Energy, which saw a staggering 12% drop, followed closely by Tata Steel, down 10%, and Hindustan Copper, which fell 9%. Other major players like Vedanta, National Aluminium, SAIL, and Hindustan Zinc also lost approximately 8%, causing alarm among investors on Dalal Street.

As uncertainty looms, foreign investors are withdrawing capital from emerging markets such as India. While Indian companies like JSW Steel, Vedanta, NALCO, and Hindustan Zinc are banking on robust domestic demand and global diversification strategies for long-term growth, the short-term outlook appears precarious.

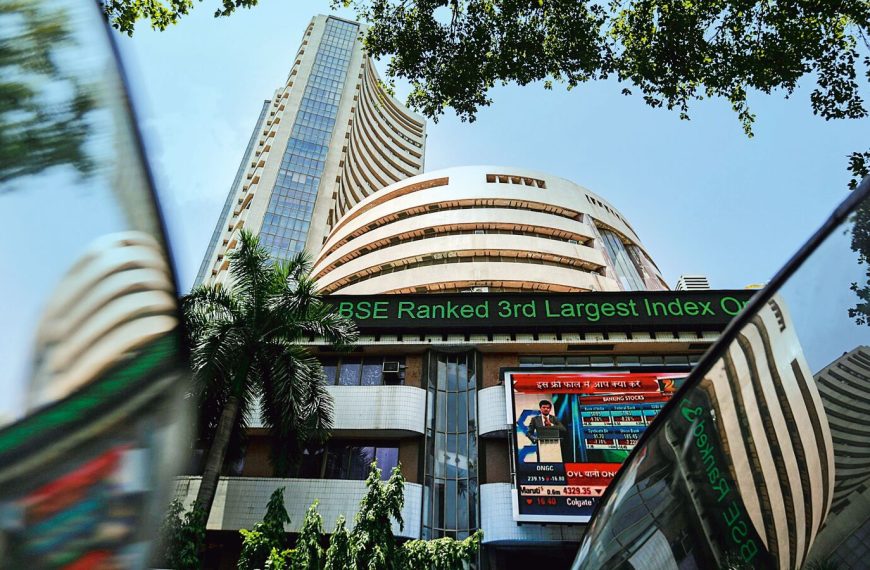

Dalal Street in Decline

The selloff on Dalal Street has been severe, with benchmark indices declining significantly during intraday trading. The Sensex dropped by 2,869 points (a 3.81% decrease), landing at 72,495.62, while the Nifty fell 960 points (down 4.19%) to 21,944.30.

Earlier in the day, the Sensex had plummeted over 3,000 points, reaching a low of 71,425, while the Nifty briefly dipped below 21,750.

Market Overview: A Broad-Based Decline

The market’s decline is widespread, affecting all sectoral indices. Sectors such as media, real estate, automotive, IT, and metals have all seen declines ranging from 5% to 7%. Broader indices, including the BSE Midcap and Smallcap, have also experienced losses exceeding 5% each. This sharp downturn is a reaction to ongoing global trade tensions, fears of an impending recession in the US, and continued outflows of foreign investment, raising alarms about a potential extended market slump.

In light of these developments, investors are urged to stay informed and consider the implications of ongoing geopolitical tensions on market stability.