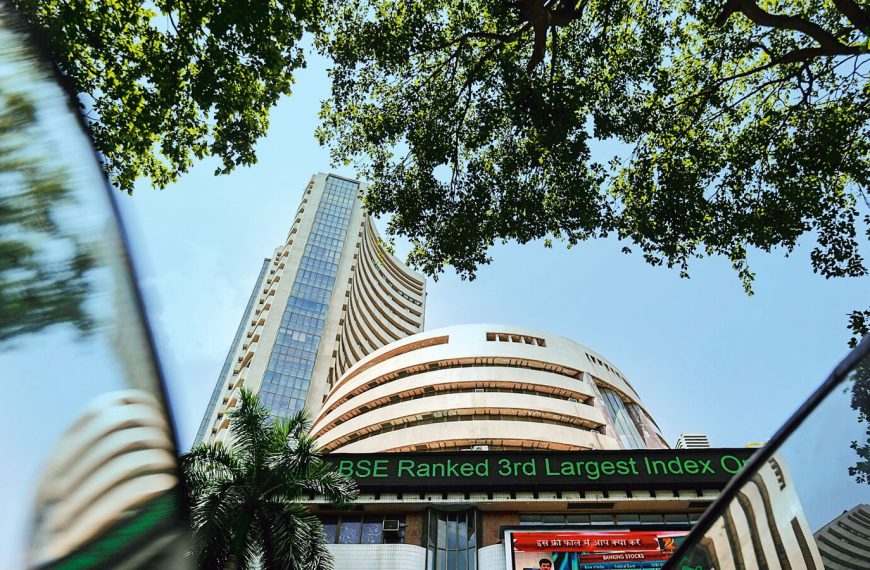

The Indian stock market has experienced a remarkable rebound, with the Sensex and Nifty 50 indices soaring over 6% in just four trading sessions. This surge is attributed to a combination of factors: a temporary suspension of tariffs by the U.S., renewed interest from foreign investors, and forecasts predicting above-average rainfall for the upcoming southwest monsoon season. These elements have significantly boosted investor sentiment and confidence in the market.

Market Performance Overview

In the past week, the BSE benchmark index has surged by 4,706.05 points, representing a 6.37% increase, while the Nifty 50 climbed 1,452.5 points, or 6.48%. This impressive performance has led to an increase in total investor wealth by ₹25.77 lakh crore, bringing the total market capitalization to ₹4,19,60,046.14 crore, approximately USD 4.90 trillion. It’s worth noting that the markets were closed on April 18, 2023, in observance of Good Friday.

Factors Driving Growth

Market analysts have pointed to several key reasons behind this recent rally:

- U.S. Tariff Relief: The temporary halt in tariffs from the U.S. has provided a much-needed boost to investor confidence.

- Foreign Investment Resurgence: The return of foreign investors to the Indian market has played a crucial role in lifting the indices.

- Monsoon Predictions: Optimistic forecasts for rainfall during the southwest monsoon season have further enhanced market sentiment.

- Decline in Retail Inflation: Retail inflation has dropped to its lowest level in nearly six years, raising expectations of a potential third interest rate cut by the Reserve Bank of India (RBI).

Upcoming Earnings Season

According to Vishnu Kant Upadhyay, Assistant Vice President of Research & Advisory at Master Capital Services, the durability of this upward trend will hinge significantly on the upcoming Q4 earnings season. Major corporations are set to announce their quarterly and full-year earnings soon, and these results will be pivotal in shaping market direction. If earnings fail to meet expectations, it could dampen current market optimism.

Looking Ahead: Expert Insights

Dharmesh Shah, Vice President at ICICI Securities, shares an optimistic outlook for the Indian equity market:

- The Nifty 50 has showcased strong recovery, reclaiming the 23,800 mark, and is expected to target 24,200 in the coming weeks.

- The Bank Nifty, which significantly influences the Nifty 50, has shown a swift recovery, indicating a structural turnaround.

- Despite recent gains of 10% and 11% in the Nifty 50 and Bank Nifty respectively, there’s a possibility of a minor pullback. This should be viewed as a buying opportunity for quality stocks, particularly during the earnings season.

Recommendations for Investors

Based on current market conditions, Dharmesh Shah suggests the following stocks for potential investment:

-

UltraTech Cement Ltd

- Buy Price Range: ₹11,400 – ₹11,890

- Target Price: ₹12,965

- Stop Loss: ₹10,778

- Hindustan Aeronautics Ltd (HAL)

- Buy Price Range: ₹4,140 – ₹4,240

- Target Price: ₹4,698

- Stop Loss: ₹3,914

Conclusion

The recent rally in the Indian stock market reflects a combination of favorable economic indicators and investor confidence. As the earnings season approaches, market participants will be keenly watching corporate performance to gauge future trends. For those looking to invest, this is an opportune moment to consider quality stocks while keeping an eye on global market dynamics. Remember, strategic buying on dips can be a wise approach during this volatile period.