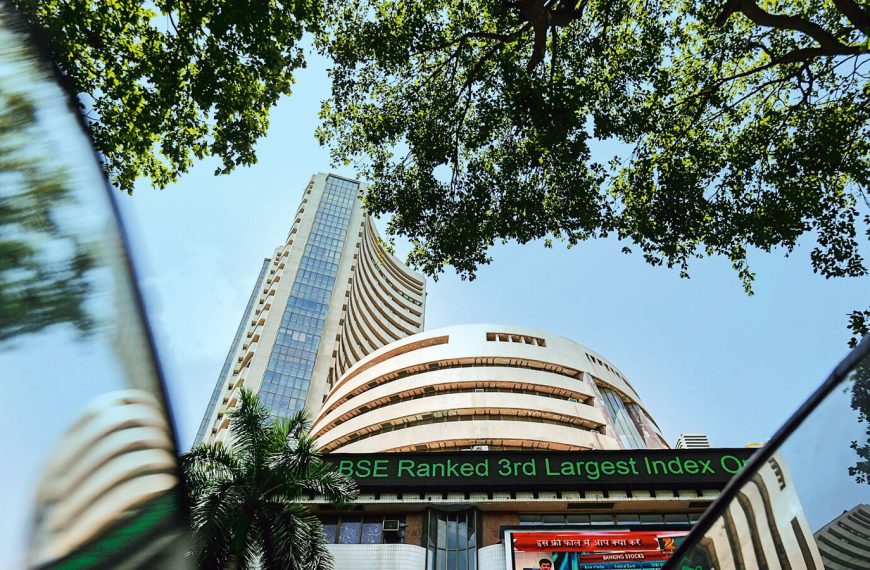

The Indian stock market is poised for a positive start today, fueled by uplifting global trends following a sharp decline in the previous session. On Monday, the benchmark indices, Sensex and Nifty 50, experienced their most significant drop in ten months, primarily due to concerns surrounding the economic implications of escalating global trade tensions linked to U.S. President Donald Trump’s tariff policies.

Major Declines in Stock Indices

On Monday, the Sensex plummeted by 2,226.79 points, or 2.95%, concluding at 73,137.90. Similarly, the Nifty 50 saw a decline of 742.85 points, or 3.24%, ending at 22,161.60. The market’s performance has raised alarms among investors, reflecting the uncertainty in global trade dynamics.

Options Market Insights

Chandan Taparia, the Head of Derivatives and Technicals at MOFSL, shared insights into the Nifty options landscape.

- Maximum Call Open Interest (OI) is observed at 23,000 and 23,500 strikes.

- Maximum Put OI is positioned at 22,000 and 21,500 strikes.

Taparia noted that call writing is evident at 22,000 and 22,500, while put writing is seen at 21,800 and 21,500. According to the option data, the broader trading range is projected between 21,600 and 22,800, with an immediate focus on the 21,900 to 22,500 levels.

Nifty 50 Analysis

The Nifty 50 formed a bullish candle pattern on the daily chart but has been consistently making lower highs over the last five sessions. Taparia warns that unless it stays above 22,222, a downward trend could push it towards 21,900 and 21,750. Resistance levels have shifted to 22,350 and 22,500.

Bank Nifty Overview

The Bank Nifty index also showed a minor bullish trend but closed down by about 1,640 points on Monday, revealing persistent selling pressure. The index has dropped below its 200 DEMA, indicating a range breakdown. Taparia suggests that if it remains under 50,250, further weakness could lead it to 49,500 and 49,000, while resistance is noted at 50,250 and 50,500.

Stock Recommendations for Today

Taparia has identified two stocks to buy and one to sell for April 8:

-

Marico:

- Buy: Target Price of ₹692

- Stop Loss: ₹647

- Marico’s share price exhibits a rounding bottom pattern with strong volume, showing resilience despite market pressures.

-

InterGlobe Aviation (IndiGo):

- Buy: Target Price of ₹5,285

- Stop Loss: ₹4,865

- The stock has demonstrated a solid breakout from a consolidation phase, supported by a rising ADX line, confirming a bullish trend.

- Granules India:

- Sell: Target Price of ₹412

- Stop Loss: ₹454

- Granules is currently in a downtrend, struggling with resistance at its 20 DEMA. A bearish MACD crossover hints at continued downward momentum.

As investors navigate today’s trading session, staying informed about market trends and stock performance is crucial for making strategic decisions.