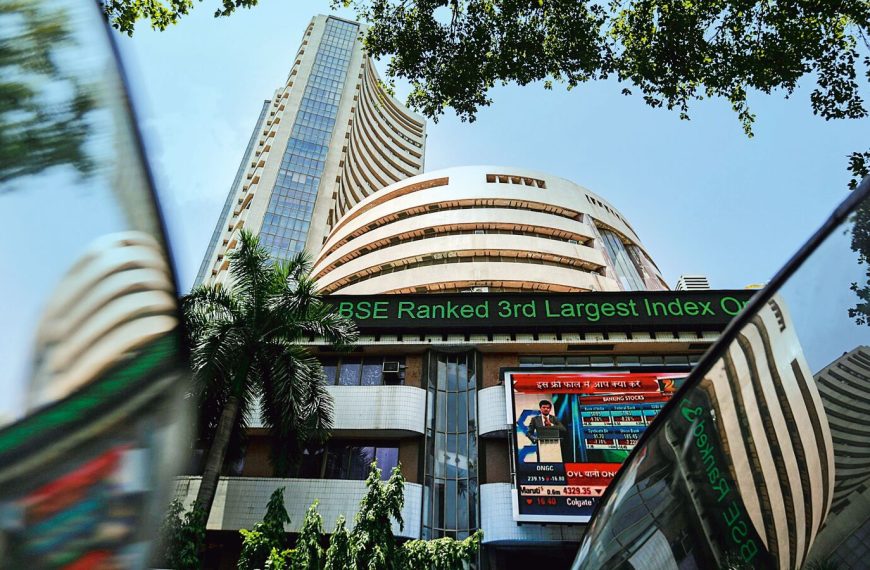

Intraday Stock Opportunities Under ₹100 Amid Market Fluctuations

As global market sentiments wavered, the Indian stock market faced a rocky start on Tuesday. However, it managed to recover from earlier losses and ultimately closed relatively unchanged. The Nifty 50 index saw a modest increase of 37 points, finishing at 22,497, while the BSE Sensex dipped slightly to 74,102. The Bank Nifty also saw a decline, ending the day at 47,853.

Major Market Movements

One of the day’s most significant events was the drastic fall of IndusInd Bank, which witnessed a staggering 27% drop, hitting a 52-week low. This steep decline followed the bank’s announcement of irregularities in its derivatives accounting, stirring anxiety among investors and analysts alike.

- Nifty Midcap Index showed resilience, rebounding to close up by 0.67%.

- In contrast, the Nifty Smallcap Index ended lower by 0.8%, despite an early recovery attempt that saw it rise over 1%.

For the second consecutive day, declining stocks outnumbered those that advanced, with the BSE advance-decline ratio at 0.60. Interestingly, cash market volumes on the NSE rose by 10% compared to the previous day.

Insights on Market Outlook

Looking ahead, Siddhartha Khemka, the Head of Research at Motilal Oswal Wealth Management, commented on the market’s trajectory: “We anticipate the market to follow global cues and remain in a consolidation phase due to the lack of significant domestic catalysts.”

Nagaraj Shetti, Senior Technical Research Analyst at HDFC Securities, provided insights on the Nifty 50, stating, “The index is currently attempting to establish a new higher bottom around 22,300. A substantial move above the 22,700 to 22,800 range could indicate a bullish trend, potentially unlocking further upward movement. Immediate support for today is at 22,315.”

Bank Nifty Analysis

Om Mehra, a Technical Analyst at SAMCO Securities, shared his perspective on the Bank Nifty, which closed at 47,853.95, down 0.75%. He noted, “The index fell below its previous swing low of 47,841 and reached an intraday low of 47,702.90. The gap-down opening, primarily due to the decline in IndusInd Bank’s stock, has worsened the outlook. The Nifty Bank is currently under the 9 EMA. With a daily RSI of 36, weak momentum is likely to persist unless it reclaims 48,500 on a closing basis. Key support levels are at 47,450 and 47,200.”

Recommended Stocks Under ₹100 for Intraday Trading

Market analysts have identified several promising stocks under ₹100 that traders may consider for today:

- Setco Automotive: Buy at ₹18.17, target ₹20.02, stop loss ₹17.39 (Sumeet Bagadia, Choice Broking).

- NACL Industries: Buy at ₹71.21, target ₹76.50, stop loss ₹68.50 (Sumeet Bagadia, Choice Broking).

- SJVN: Buy at ₹85 to ₹86.25, targets of ₹88, ₹90, ₹92, and ₹94, stop loss ₹83.80 (Mahesh M Ojha, Hensex Securities).

- Manali Petrochemicals: Buy at ₹61 to ₹62, targets of ₹63.50, ₹65, and ₹67, stop loss ₹59.20 (Mahesh M Ojha, Hensex Securities).

- Jamna Auto: Buy at ₹71.50, target ₹74.50, stop loss ₹69.80 (Sugandha Sachdeva, SS WealthStreet).

- Lloyds Engineering: Buy at ₹57.50, target ₹60, stop loss ₹56 (Anshul Jain, Lakshmishree Investment and Securities).

Conclusion

As traders navigate through the fluctuating market landscape, keeping an eye on these recommended stocks under ₹100 might present lucrative opportunities. Be sure to stay updated with market trends and expert analyses for making informed investment decisions.