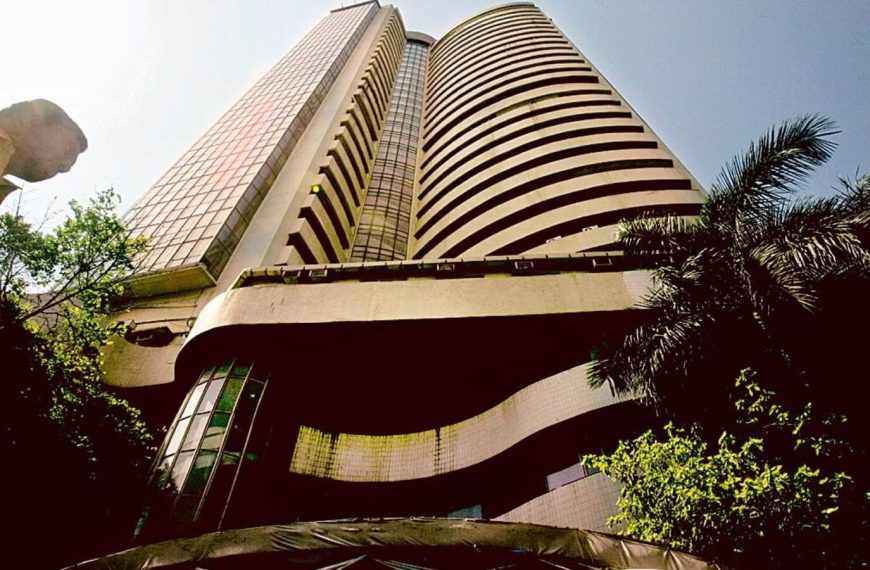

In the past week, the Indian stock market experienced notable shifts, particularly among the top-valued companies. Despite a holiday-shortened trading week, the combined market capitalization of five leading firms increased by Rs 84,559.01 crore, with Hindustan Unilever leading the charge. However, the broader market saw declines, with the BSE Sensex falling by 207.43 points and the NSE Nifty decreasing by 75.9 points.

Key Market Movements

The Indian stock markets were closed on Thursday in observance of Shri Mahavir Jayanti. While several firms saw their valuations rise, others faced significant losses. The notable gainers included:

- Hindustan Unilever: Gained Rs 28,700.26 crore, reaching Rs 5,56,054.27 crore.

- Reliance Industries: Increased by Rs 19,757.27 crore, bringing its market cap to Rs 16,50,002.23 crore.

- ITC: Rose by Rs 15,329.79 crore, with a total valuation of Rs 5,27,845.57 crore.

- Bajaj Finance: Jumped by Rs 12,760.23 crore, now valued at Rs 5,53,348.28 crore.

- Bharti Airtel: Climbed by Rs 8,011.46 crore, reaching Rs 10,02,030.97 crore.

Declines in Major Firms

Conversely, several leading companies saw their valuations dip:

- Tata Consultancy Services (TCS): Experienced a loss of Rs 24,295.46 crore, dropping to Rs 11,69,474.43 crore.

- Infosys: Eroded by Rs 17,319.11 crore, now valued at Rs 5,85,859.34 crore.

- State Bank of India: Fell by Rs 12,271.36 crore, with a market cap of Rs 6,72,960.97 crore.

- ICICI Bank: Dipped by Rs 8,913.09 crore, now at Rs 9,34,351.86 crore.

- HDFC Bank: Decreased by Rs 7,958.31 crore, bringing its valuation to Rs 13,82,450.37 crore.

Current Rankings

At present, Reliance Industries holds its position as the highest-valued company in India, followed closely by HDFC Bank and TCS. The rankings of the top firms are as follows:

- Reliance Industries

- HDFC Bank

- TCS

- Bharti Airtel

- ICICI Bank

- State Bank of India

- Infosys

- Hindustan Unilever

- Bajaj Finance

- ITC

As the market continues to fluctuate, investors are keenly watching these developments. With the next trading opportunities on the horizon, the focus will be on whether these gains can be sustained and if the declining firms can turn their fortunes around.

Stay tuned for more insights into the dynamic landscape of Indian stocks!