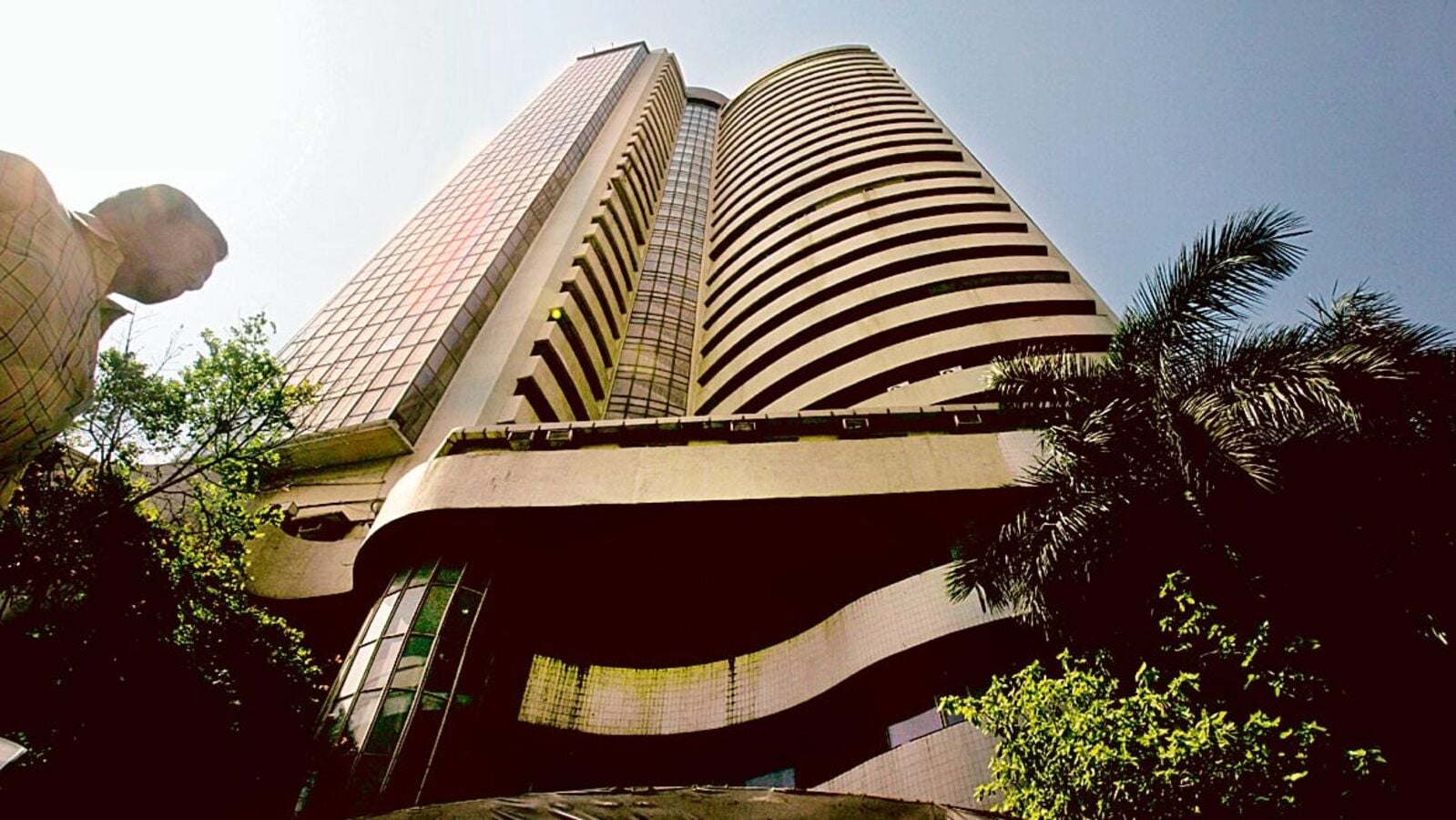

The Indian stock market witnessed a significant rebound on Monday, March 17, recovering from last week’s volatility. This surge was fueled by robust performances in the financial, pharmaceutical, and automotive sectors, leading to a positive closing for major indices. The upward momentum was partly influenced by a relief rally on Wall Street last Friday, which positively impacted Asian markets during Monday’s trading session.

Market Dynamics: Positive Influences and Sector Performance

The market’s positive trajectory was further supported by China’s recent announcement of initiatives aimed at boosting domestic consumption, which invigorated the local metal stocks. As the trading day progressed, both IT and oil & gas sectors showed signs of recovery, although FMCG and realty stocks continued to struggle, prolonging their bearish trends.

- The Nifty 50 concluded with a 0.50% increase, reaching 22,508 points, thus breaking a two-day decline.

- The Sensex also rose, closing at 74,169 points, which is 0.46% higher than its previous close, ending a five-day losing streak.

The broader market experienced a notable uptick as well, with the Nifty Midcap 100 index climbing 0.70% to finish at 48,461 points, while the Nifty Smallcap 100 index appreciated by 0.48%, closing at 14,968 points.

Sectoral Highlights: Pharma Leads the Charge

In terms of sectoral performance, Nifty Pharma stood out as the top performer, gaining 1.56%. Remarkably, 19 out of 20 companies within this index posted gains, with Dr. Reddy’s Laboratories, Granules India, and Biocon leading the charge with increases of up to 4%. The Nifty Auto sector also bounced back impressively, closing with a 0.91% gain after facing significant selling pressure the previous week.

Other sectors saw mixed results, with Nifty Metal and Nifty Consumer Durables concluding the session with modest gains ranging from 0.23% to 0.77%.

- Nifty Media continued its downward trend for a third consecutive session, dipping by 0.65%.

- Nifty Realty also faced challenges, sliding 0.38% further.

Expert Insights: Market Outlook

Vinod Nair, the Head of Research at Geojit Financial Services, commented on the market’s performance, noting that the positive trading session was largely driven by strength in the healthcare and financial sectors. However, he cautioned that diminished participation from domestic investors, influenced by tariff uncertainties, might lead to fluctuations in the market in the short term.

He stated, “Decisive momentum will hinge on signs of earnings growth. Improved domestic economic indicators hint at a potential recovery, but traders are closely watching the upcoming FED and BOJ meetings, expecting them to maintain their current stances due to inflation risks tied to tariff issues.”

Technical Analysis: Key Levels to Watch

Ajit Mishra, Senior Vice President of Research at Religare Broking, shared insights on the Nifty 50, which is currently seeking a decisive trigger to break through the 20-day exponential moving average (DEMA) barrier around 22,600 points. He emphasized that while the banking and financial sectors bolster market sentiment, the underperformance of other heavyweights is restraining further upside.

Mishra advised investors to focus on stock selection based on relative strength during this consolidation phase, awaiting clearer signals for future movements.

In summary, the Indian stock market is showing signs of recovery, with key sectors bouncing back and experts suggesting cautious optimism as economic indicators improve and upcoming meetings are closely monitored.