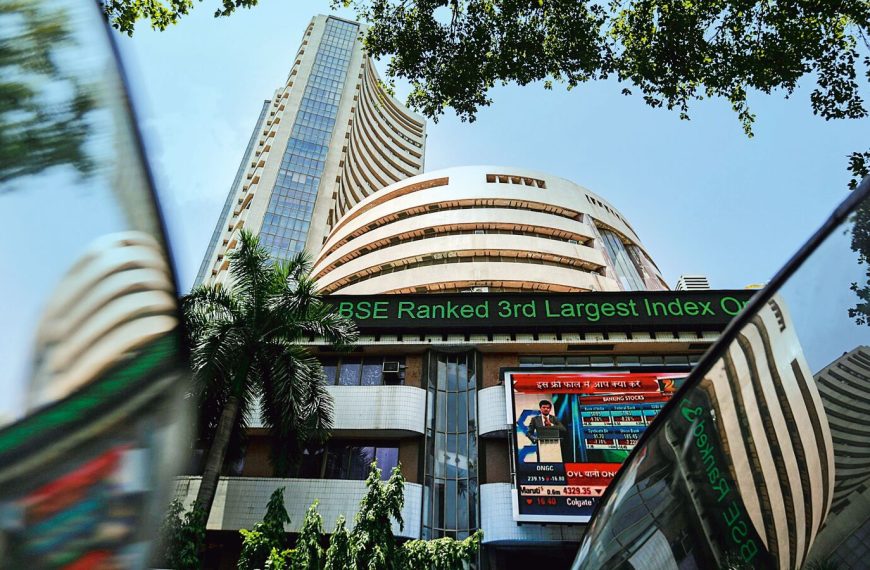

The Indian stock market is off to a bright start today, with the benchmark indices, Sensex and Nifty, showing positive momentum. This optimism is largely a response to a robust rally on Wall Street, where the U.S. Federal Reserve opted to maintain interest rates, providing a sense of stability. Additionally, Asian markets are reflecting this positive sentiment, with notable gains in Australia and South Korea.

Key Market Developments

Federal Reserve’s Decision to Hold Rates Steady

In its latest policy meeting, the U.S. Federal Reserve made a significant announcement, keeping interest rates unchanged at 4.25% to 4.50%. This marks a pivotal moment in monetary policy, especially as it is the first major decision since Donald Trump resumed the presidency in January 2025.

China’s Lending Rates Remain Unchanged

In parallel, the People’s Bank of China has decided to keep its key lending rates steady. The one-year loan prime rate remains at 3.1%, while the five-year rate is at 3.6%. This cautious approach aims to balance economic growth with currency stability, following the last rate cut in October.

Wall Street’s Strong Performance

U.S. markets experienced a significant rebound, with major indices recovering from previous losses. The S&P 500 surged more than 1%, closing at 5,675.29. Similarly, the Dow Jones Industrial Average rose nearly 1% to finish at 41,964.63, while the Nasdaq Composite led the charge with a robust gain of 1.5%, settling at 17,750.79.

Nifty Market Snapshot

As of midday, the Nifty market is showing active trading with 2,865 stocks exchanged. Notably:

- Advances vs. Declines: 1,886 stocks gained while 910 faced declines.

- Highs and Lows: 33 stocks reached 52-week highs, and 42 hit 52-week lows.

- Circuit Limit: 146 stocks hit the upper circuit, whereas 34 reached the lower circuit.

Notable Movers in the Market

- Bharti Airtel is shining as the top gainer in the Nifty 50, trading 2.15% higher in intraday sessions. This reflects a year-to-date increase of nearly 5%.

- Other strong performers include M&M, TCS, HCL Tech, and Eicher Motors.

Conversely, stocks such as Bajaj Finance, Trent, Apollo Hospital, Larsen & Toubro, and Tata Steel are facing losses.

Expert Insights on Market Trends

According to Anand James, Chief Market Strategist at Geojit Financial Services, the market is expected to experience volatility within the 23,100-22,730 range. He notes that a significant pullback below 22,800 could occur unless the market clears 23,100.

Future Outlook

Looking ahead, market analysts are closely monitoring the implications of the Federal Reserve’s decision to maintain the current interest rates. With projections of lower growth at 1.7% and higher inflation at 2.8% for 2025, the Fed’s approach remains highly flexible, possibly adapting based on evolving economic conditions.

Spotlight on Ola Electric

In a different sector, Ola Electric Mobility is under scrutiny as the Ministry of Heavy Industries has raised concerns regarding discrepancies between reported sales figures and actual vehicle registrations. This investigation comes at a crucial time as the company prepares for a public listing.

Conclusion

The overall sentiment in the Indian stock market today reflects a mix of optimism fueled by international developments and local dynamics. As traders navigate through the day’s fluctuations, staying informed on key movements and expert analyses will be crucial for strategic decision-making. Stay tuned for more updates as the market progresses.