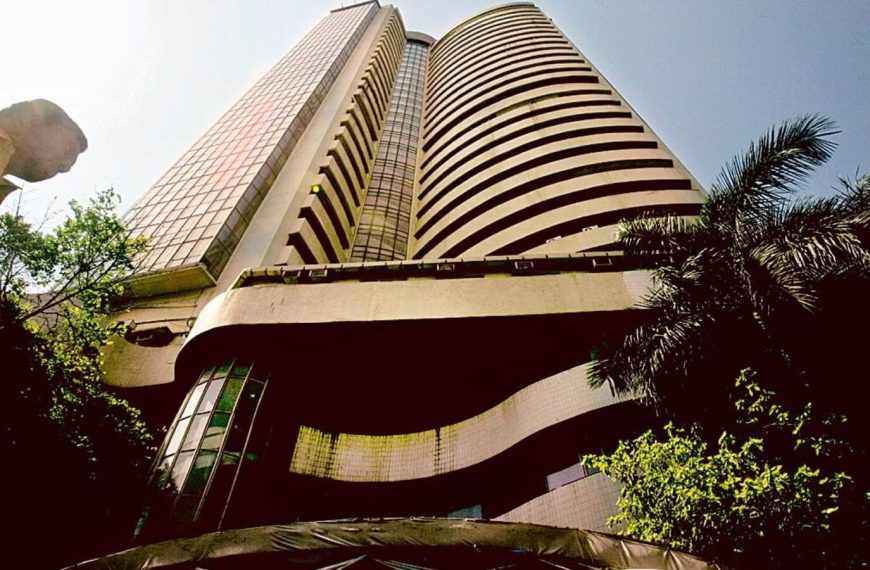

The Indian stock market maintained its upward momentum, achieving significant gains for the fourth consecutive day on March 20, 2025. The Sensex soared by 899 points, or 1.19%, concluding at 76,348, while the Nifty 50 rose by 283 points, or 1.24%, reaching 23,190.65. This widespread buying frenzy not only boosted major indices but also increased the total market capitalization of BSE-listed companies to over ₹408 lakh crore, an increase of more than ₹3 lakh crore in a single day.

Reasons Behind the Market Surge

The rally in the Indian stock market can be attributed to several key factors:

- Valuation Comfort: Investors are finding value in large-cap stocks after a recent correction.

- Positive Economic Indicators: Improvements in economic metrics are encouraging market participation.

- FII and DII Dynamics: A decline in the US dollar index has reduced foreign institutional selling, while domestic institutions continue to buy actively.

Vinod Nair, Head of Research at Geojit Financial Services, explained, “The consistent drop in the US dollar index has alleviated the pressure from foreign investors, while domestic investors remain bullish. This dynamic is fueling the current market rally.” Nair also highlighted the encouraging domestic data, which suggests a rise in economic activity, further enhancing the appeal of equities.

Nifty 50 Highlights

On this noteworthy trading day, a remarkable 44 stocks within the Nifty 50 index saw gains. The standout performers included:

- Bharti Airtel: Up 4.08%

- Titan: Up 3.47%

- Eicher Motors: Up 2.61%

Conversely, some stocks posted losses, with IndusInd Bank down 1.11%, Bajaj Finance down 0.59%, and Trent down 0.30%.

Sector Performance

Every sector on the market showed positive movement, with notable gains across:

- Nifty Auto

- FMCG

- IT

- Media

- Metal

- Oil & Gas

- Consumer Durables

- Healthcare

- Realty

The Nifty Bank index increased by 0.72%, while the Financial Services sector rose by 0.70%.

Volume Leaders and Market Trends

Several stocks led in trading volume on the NSE:

- Vodafone Idea: 47.50 crore shares

- YES Bank: 8.07 crore shares

- Easy Trip Planners: 7.27 crore shares

Additionally, 69 stocks, including IndiGo and Muthoot Finance, reached new 52-week highs, showcasing the bullish sentiment in the market.

Broader Market Metrics

The advance-decline ratio favored the gainers, with 1,759 stocks advancing compared to 1,143 that declined. Meanwhile, 106 stocks hit 52-week lows, indicating mixed performance across the board.

Technical Outlook for Nifty 50

According to Rupak De, a Senior Technical Analyst at LKP Securities, the Nifty 50 has successfully broken through a falling trendline, suggesting a potential bullish reversal. He noted that the index has been consistently above the 21 EMA for the last three days, indicating a short-term upward trend. De remains optimistic about the market’s trajectory, projecting that the Nifty could target 23,400 and beyond, with immediate support at 23,000.

For more updates and insights on market trends, stay tuned to our financial news platform.