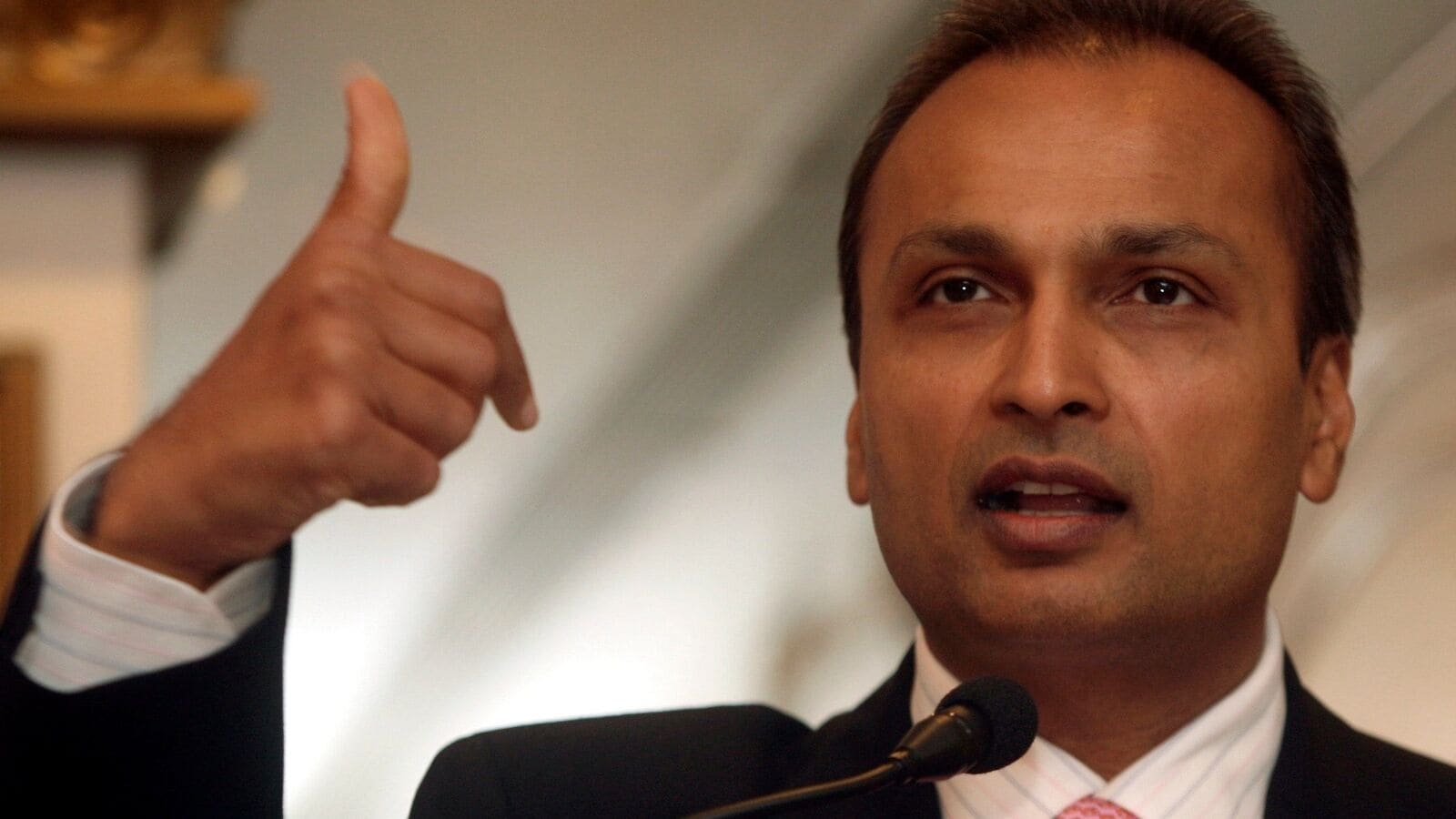

In recent weeks, Reliance Power has witnessed a remarkable surge in its share price, climbing nearly 20% despite the turmoil in the Indian stock market fueled by uncertainties surrounding Donald Trump’s tariffs. This performance stands out, especially when compared to the Nifty 50 and BSE Sensex, which have only moved modestly. Investors are now keenly observing this Anil Ambani-led company as it recovers from past lows.

Strong Recovery from Historical Lows

After hitting a staggering low of Re 1 per share in March 2020, Reliance Power’s stock has rebounded to around ₹40. However, it’s important to note that the stock still has a long way to go, having previously traded at an impressive ₹375. Many investors holding Reliance Power shares are pondering whether to retain their investments for potential future gains or to cash out now and possibly re-enter later at a lower price.

Factors Behind the Stock’s Surge

Experts attribute the recent rise in Reliance Power’s share price to several key developments:

- Debt Reduction: The company has made significant strides in reducing its debt load, notably through the sale of Reliance Capital to IndusInd International Holdings (IIHL). This transaction improved its debt-to-equity ratio from 1.61 to 0.86.

- Recent Profit Reports: In the September 2024 quarter, Reliance Power reported a net profit of ₹2,878 crore, largely driven by an exceptional income of ₹3,000 crore from the deconsolidation of its subsidiary, Vidarbha Industries Power Limited (VIPL).

- Operational Efficiency: The company’s thermal power plants have been performing exceptionally well, contributing to its overall recovery.

Expert Opinions on Future Prospects

Nitin Kotiyal, a Senior Research Analyst at Fynocrat Technologies, pointed out that while Reliance Power is making strides in managing its debt, it still holds ₹250 crore in Non-Convertible Debentures (NCDs). Although the company claims to have no bank debt, it is still not entirely debt-free. Future plans to issue Foreign Currency Convertible Bonds (FCCBs) could add to its debt load, which investors should keep in mind.

Kotiyal emphasized that despite a net profit primarily resulting from exceptional income, the company has yet to show consistent profitability from its core operations. However, it is focusing on clean energy projects and has recently secured a significant solar and battery storage contract, one of the largest in Asia.

Investment Recommendations and Stock Targets

Looking ahead, Mahesh M Ojha from Hensex Securities believes that Reliance Power’s stock is poised for further gains. He noted the stock has established a solid support level at ₹36, with a resistance hurdle at ₹44. A successful breakout above this level could see the share price reaching ₹48 and ₹52.

For those considering investing, Ojha advises high-risk investors to consider initiating purchases at current levels while maintaining a stop-loss at ₹36 to safeguard against potential downturns.

Conclusion

As Reliance Power navigates through its recovery phase, investors are keenly watching its strategic moves in the market. With a mix of solid operational performance and aggressive debt management, the company is positioning itself for potential growth. Keeping an eye on market trends and expert insights will be crucial for shareholders as they decide on their investment strategies moving forward.