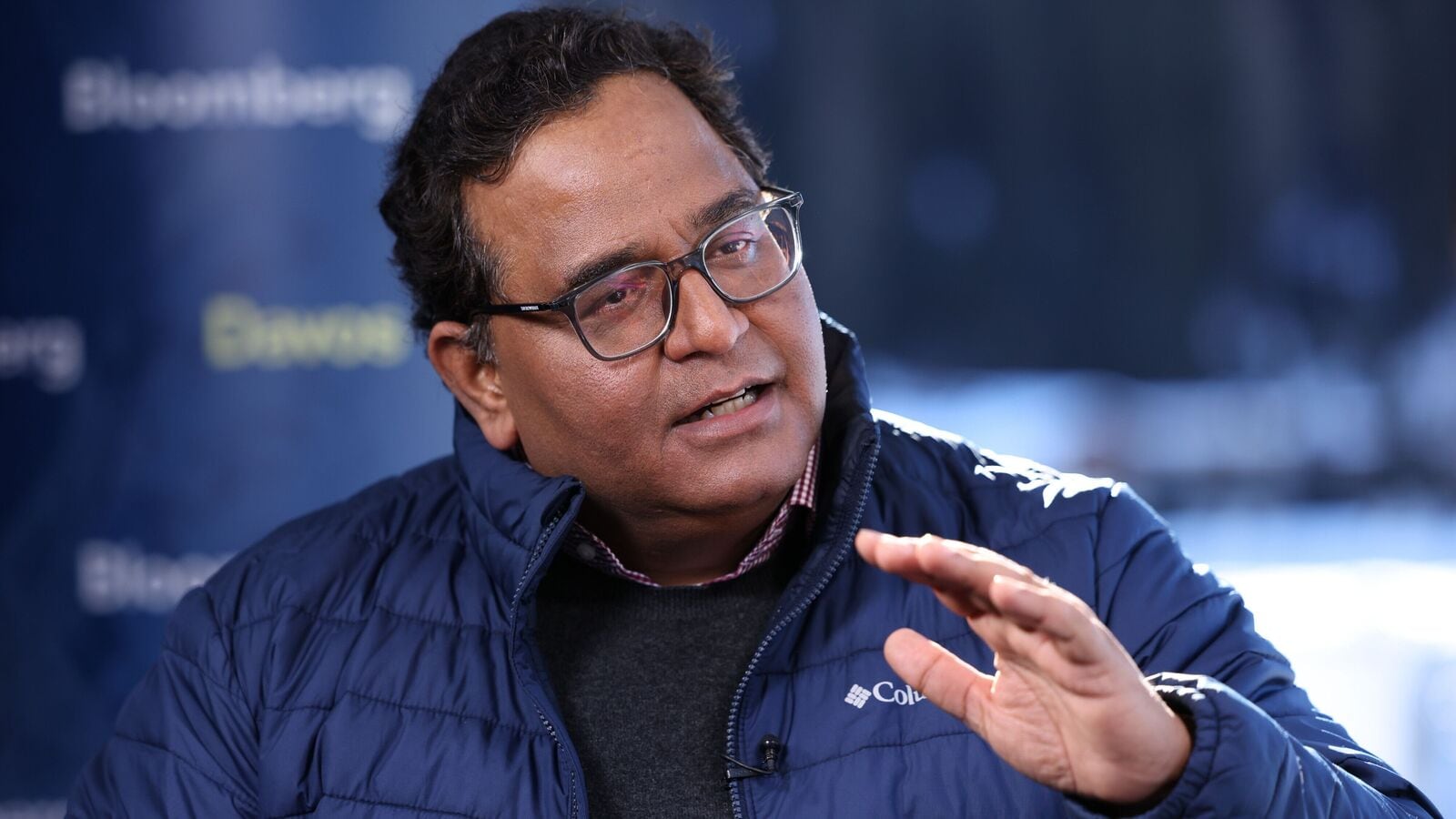

In a significant move that underscores corporate governance, Vijay Shekhar Sharma, the founder and CEO of Paytm, has decided to relinquish 21 million employee stock options (ESOPs). This decision, announced on April 16, 2025, comes shortly after the Securities and Exchange Board of India (SEBI) raised concerns regarding compliance with regulations governing share-based employee benefits.

The ESOP Details

Sharma’s voluntary forgoing of these ESOPs, valued at over ₹1,800 crore, is a pivotal moment for the fintech giant. According to a regulatory filing, Sharma communicated this decision to the company, stating that the ESOPs will be returned to the pool for future grants under the One 97 Employees Stock Option Scheme, 2019.

- Immediate Impact: The cancellation of some unvested ESOPs means that the company will experience a one-time, non-cash ESOP expense acceleration of ₹492 crore in the fourth quarter of FY 2025. This adjustment will subsequently reduce ESOP expenses in ensuing years.

Paytm’s Stock Performance

Despite market fluctuations, Paytm’s share price has shown resilience, recently closing at ₹864.5 per share. The value of the ESOPs reflects this stability, highlighting the company’s ongoing recovery since its IPO in November 2021.

Background on the ESOP Allocation

Sharma was granted these ESOPs when One97 Communications, the parent company of Paytm, went public. Before the listing, he owned a 14.7% stake but adjusted his holdings to 9.1% to comply with eligibility criteria for the ESOPs by transferring shares to a family trust represented by Axis Trustee Services.

SEBI’s Regulatory Scrutiny

The backdrop to Sharma’s decision includes scrutiny from SEBI, which issued show-cause notices regarding potential misrepresentation during the IPO process. These notices were aimed at Sharma and other board members, emphasizing the importance of transparency in corporate governance.

Recent Changes in ESOP Policy

In March 2025, Paytm amended its ESOP policy, aligning the vesting of these options with annual performance evaluations. This adjustment reflects a broader strategy aimed at enhancing employee motivation and accountability. Moreover, the company has expanded its ESOP pool, granting options to eligible employees on multiple occasions over the past six months.

Conclusion

Sharma’s choice to forgo these stock options is not just a personal sacrifice; it represents a commitment to corporate responsibility and compliance amidst regulatory challenges. As Paytm navigates the complexities of the financial markets, this move may bolster investor confidence and pave the way for sustainable growth in the fintech sector.