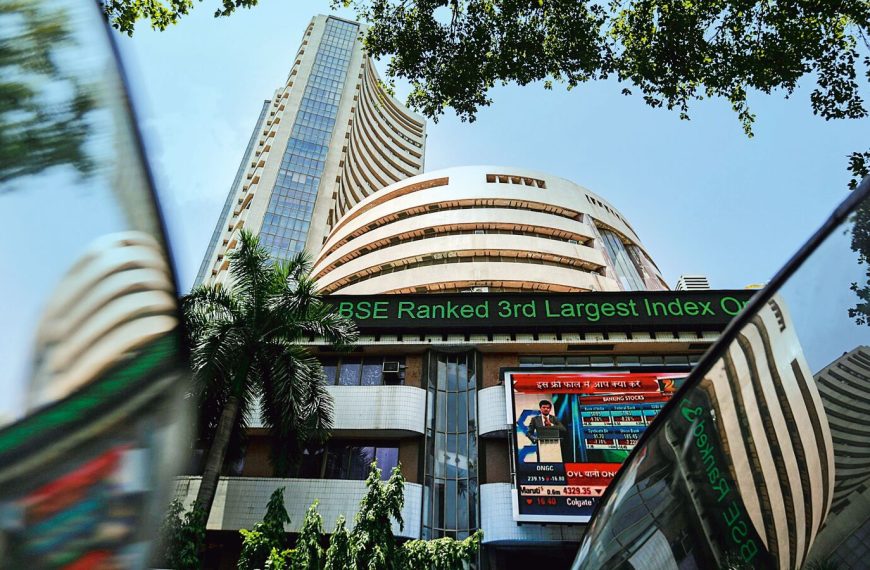

Indian stock markets experienced a significant downturn on April 7, marking one of the most alarming sell-offs in recent memory. Both the Sensex and Nifty opened sharply lower amid widespread fear of a global trade conflict, primarily triggered by escalating tensions surrounding U.S. tariffs. This unexpected market plunge reflects a broader unease gripping investors worldwide.

Market Overview: A Sudden Decline

At the start of trading, the BSE Sensex plummeted by 3,379.19 points, or 4.48%, settling at 71,985.50. Similarly, the Nifty 50 saw a steep drop of 901.05 points, equivalent to 3.93%, reaching 22,003.40. This marks the steepest decline for Indian markets since March 2020, highlighting the volatility currently affecting investors.

- Market Capitalization Loss: NSE companies collectively lost around ₹20 lakh crore.

- Broader Market Impact: The Nifty Midcap index fell by 4%, while the Nifty Smallcap index dropped by 5%.

Global Context: A Ripple Effect

The sharp decline in Indian equities is part of a larger trend observed across global markets. On the previous evening, Wall Street futures were down nearly 4%, causing a chain reaction through the Asia-Pacific region, where markets generally saw declines ranging from 4% to 6%.

Experts suggest that this market behavior is indicative of a global risk-off sentiment, as investors brace for the potential economic fallout from an escalating trade war. Given the ongoing situation, traders are likely to adopt a cautious approach in the immediate future.

Stocks Under Pressure: A Market-Wide Panic

Every stock on the Nifty 50 opened in negative territory, with an overwhelming 80% witnessing declines of over 4%. Notably, Trent emerged as the biggest loser, dropping over 13.5%, followed by:

- Tata Steel: down 9%

- Tata Motors: down 7.6%

- ONGC and Hindalco: each down over 6%

Other significant players like HCL Tech, L&T, Tech Mahindra, Infosys, Bajaj Auto, and TCS also saw declines exceeding 5%. In addition, major companies such as Hero Moto, Adani Enterprises, Jio Financial, and several banks lost more than 3.5% each.

Sector Performance: Metals and Technology Hit Hard

The Nifty Metal index faced the brunt of the sell-off, plunging over 7% due to fears of declining global demand and retaliatory tariffs. The Nifty IT index also suffered, dropping nearly 6% as concerns about a potential global recession loomed over export-oriented firms.

In terms of sector performance:

- Nifty Auto and Nifty Realty: both fell by 5%

- Nifty Bank, Financial Services, PSU Bank, and Private Bank: each lost over 3%

- Nifty Pharma and FMCG: fared slightly better, declining by 2.7% and 1.6%, respectively.

Conclusion: A Cautious Outlook Ahead

As the global economic landscape continues to evolve, investors are likely to remain vigilant. The current sell-off reflects not just local uncertainties but a broader apprehension about international trade relationships. Keeping an eye on upcoming developments will be crucial for navigating these turbulent times in the market.