The digital landscape is buzzing with excitement over Ekagrah Rohan Murthy, the 17-month-old grandson of Narayana Murthy, who is poised to receive a staggering Rs 3.3 crore as dividends from Infosys for the fiscal year concluding in March 2025. This remarkable news highlights the generational wealth stemming from one of India’s leading tech giants.

Infosys Declares Record Dividend

In an announcement made on Thursday, Infosys revealed its highest final dividend since 2015, setting it at Rs 22 per share. Little Ekagrah, who possesses 1.5 million shares, holds a 0.04% stake in the company. This impressive dividend means he will enjoy a significant payout, reflecting the ongoing success of Infosys.

Family Stakes and Dividend Distributions

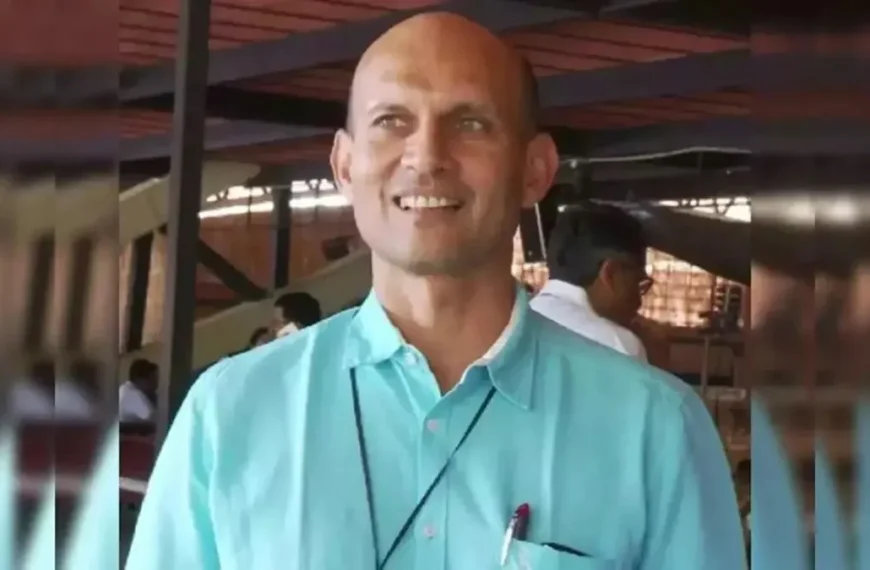

Interestingly, Ekagrah’s father, Rohan Murthy, the son of Infosys founder Narayana Murthy, holds a substantial 6.08 crore shares, representing a 1.62% stake in Infosys. Rohan is expected to receive about Rs 133.79 crore from the upcoming dividend—over 40 times the amount his son will gain.

- Rohan Murthy: 6.08 crore shares, 1.62% stake, Rs 133.79 crore dividend

- Nandan M. Nilekani, another prominent figure in the Infosys hierarchy, holds 4.07 crore shares (1.09% stake), with an estimated dividend of Rs 89.72 crore.

Sudha Gopalakrishnan’s Major Stake

Among the promoter shareholders, Sudha Gopalakrishnan, the spouse of co-founder Kris Gopalakrishnan, stands out with her ownership of 9.53 crore shares. This translates to a 2.54% stake, and she is set to receive the largest payout at approximately Rs 209.79 crore.

Key Dates and Financial Highlights

The record date for the Annual General Meeting and dividend distribution is scheduled for May 30, 2025, with payments expected on June 30, 2025. This dividend represents the highest final distribution in almost ten years, with the last notable payout being Rs 29.50 per share back in 2015.

Financial Performance Overview

In terms of financial health, Infosys reported a revenue of $19,277 million for FY25, marking a 4.2% growth in constant currency. Noteworthy metrics include:

- Operating margin of 21.1%, an increase of 0.5% year-on-year

- Free cash flow reaching a record $4,088 million, up 41.8% from the previous year

In Q4, Infosys generated revenues of $4,730 million, reflecting a 4.8% increase in constant currency. The operating margin for this quarter stood at 21%, a rise of 0.9% year-on-year.

Future Projections

Looking ahead, Infosys anticipates a revenue growth of 0-3% for FY26 in constant currency, along with an operating margin forecast of 20-22%.

For a deeper dive into the tech sector’s performance and more updates, feel free to explore our other articles.

Disclaimer: This content is intended for informational purposes only and does not constitute investment advice. Always consider consulting with financial advisors to tailor decisions to your specific financial goals.

Discover more insights at Dalal Street Investment Journal (DSIJ), a trusted source of financial media in India for nearly four decades.