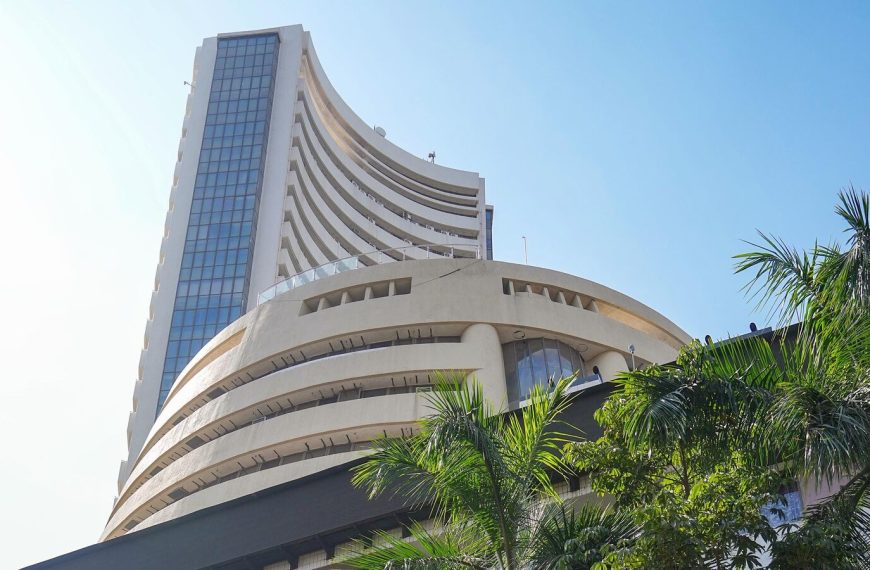

Amid growing economic uncertainty fueled by President Donald Trump‘s tariffs and escalating tensions with Federal Reserve Chairman Jerome Powell, the Indian stock market has demonstrated impressive resilience. On Tuesday, the Nifty 50 index continued its upward trajectory for the sixth consecutive session, opening at 24,185 and peaking at 24,242. Over this period, it has surged by an impressive 1,850 points. Similarly, the BSE Sensex opened higher at 79,728, reaching an intraday high of 79,824, marking a notable 6,000-point increase across six sessions.

Market Speculation and Gold Prices

As gold prices in India’s retail sector have hit a record high of ₹1 lakh per 10 grams, speculation is rife about whether the Nifty 50 can reclaim the 25,000 mark this month. Analysts suggest that the underlying factors driving the Indian stock market remain intact, indicating a probable continuation of the bullish trend on Dalal Street. Experts point out that the Nifty 50 faces significant resistance levels between 24,250-24,300 and 24,800-24,850. To achieve the coveted 25,000 milestone, it needs to decisively overcome these barriers.

Can Nifty Reach 25,000 This Month?

Discussing the potential for the Nifty to hit 25,000 this month, Avinash Gorakshkar, Head of Research at Profitmart Securities, noted, “The ongoing uncertainty regarding Trump’s tariffs has been a major catalyst for the rally in both the Indian and Asian stock markets. The recent 90-day pause in tariffs has further boosted investor sentiment. Additionally, the weakness in the US dollar, along with turbulence in equity and bond markets, is prompting Foreign Institutional Investors (FIIs) to redirect their funds from the US to emerging markets like India and China. Consequently, any corrections in Indian stocks should be viewed as a buying opportunity.”

Market Insights and Future Projections

A report from ICICI Direct suggests that much of the negative news has been absorbed by the market, indicating a base formation between 21,900-23,800.

Analyzing the Nifty 50’s current chart, Anshul Jain, Head of Research at Lakshmishree Investment and Securities, stated, “Today, Nifty tested a weekly swing high of 24,226.75 and is experiencing some profit-taking. A decisive close above this resistance could ignite momentum towards the next weekly swing high of 24,857.75.”

Key Stocks to Watch

The next phase of the rally could be propelled by metals exhibiting strong performance and the IT sector, which appears primed for a rebound. Anshul Jain emphasized the importance of sector rotation, suggesting that developments in these areas may shape the index’s forthcoming movements.

On the topic of whether the Nifty 50 can reclaim the 25,000 mark, Jain remarked, “The index has two major hurdles to clear — the first between 24,250-24,300 and the second between 24,800-24,850. With five trading sessions remaining this month, much hinges on today’s closing. If the Nifty closes at or above 24,242, we could see it break through this immediate resistance tomorrow, setting fresh targets of 24,800-24,850, and keeping hopes alive for reaching 25,000 this month.”

In summary, the Indian stock market is in an intriguing phase, with potential opportunities and challenges ahead. Investors should stay alert and consider market movements closely as they navigate this dynamic landscape.