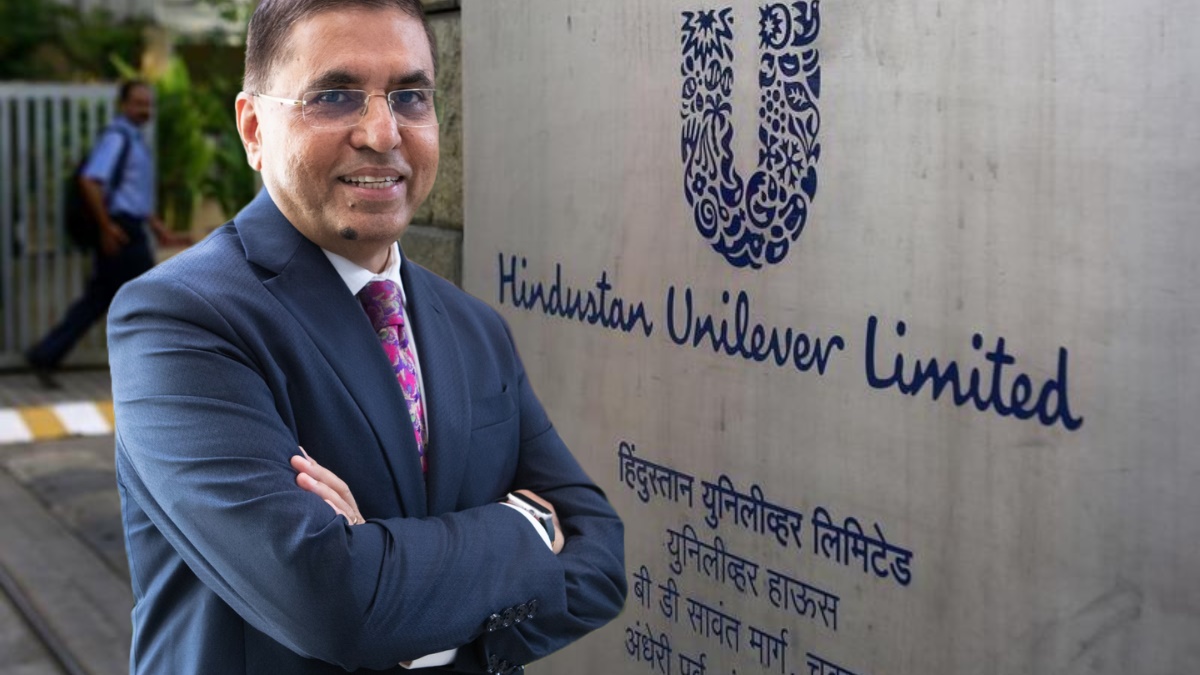

In a recent address at the IIAS Corporate Governance Scores 2024 event, Sanjiv Mehta, the former chairman and managing director of Hindustan Unilever, and current executive chairman of L Catterton India, shed light on critical areas needing reform in corporate governance. He emphasized that issues like insider trading, board independence, and transparency significantly impact investor trust and market integrity.

Insider Trading: A Threat to Market Integrity

Mehta pointed out that insider trading remains a pervasive issue that erodes confidence among investors. Despite existing regulations, he expressed concern over inadequate enforcement, stating, “Often, this practice goes unchecked, fostering a culture that undermines market integrity.”

Challenges with Board Independence

Another pressing concern raised by Mehta is the effectiveness of independent directors. He noted that many boards are still heavily influenced by majority shareholders, which compromises the objectivity of decision-making processes. “Although regulatory attempts have been made to enhance board independence, real challenges persist regarding the selection process and the genuine power independent directors wield,” he explained.

Transparency and Disclosure Deficiencies

Transparency in corporate practices is another area needing improvement. Mehta highlighted that numerous companies fail to meet the standards set by regulatory frameworks, citing common issues such as:

- Delayed financial reporting

- Incomplete disclosures of related party transactions

- Ambiguities surrounding executive compensation

“While India has advanced through the Companies Act and CME regulations, the implementation of these laws often falls short due to limited resources for enforcement,” he added.

The Path Forward: Enhancing Corporate Governance

Mehta stressed that there is much work ahead to elevate corporate governance standards. He proposed several key improvements, including:

- Strengthening board independence

- Enhancing the role of audit committees

- Promoting diversity within corporate boards

- Separating the roles of the chairman and CEO

He also pointed out that while the Companies Act requires certain companies to engage in CSR activities, many treat these initiatives as mere formalities rather than integrating them into their business strategies.

Commitment to Global Standards

According to Mehta, raising standards is essential for competing globally. This commitment is vital for attracting foreign investment, encouraging responsible corporate practices, and driving economic growth.

Adapting to Technological Advances

As AI technology becomes more embedded in corporate strategies, Mehta emphasized the need for corporate governance to evolve accordingly. He warned that while the push for sustainability is commendable, the influence of social media can sometimes lead to superficial actions that do not produce meaningful results.

Conclusion: A Holistic Approach to Governance

“Addressing these challenges will demand a comprehensive strategy that includes regulatory improvements, heightened awareness of governance principles, and a firm commitment from companies to maintain ethical practices,” Mehta concluded.

As businesses navigate these complexities, the integration of robust governance practices will be paramount in fostering a resilient and trustworthy corporate environment.