Asian markets kicked off Thursday with a remarkable surge, buoyed by a historic rally on Wall Street. This upswing came in the wake of U.S. President Donald Trump’s announcement of a temporary halt on higher tariffs for most countries, excluding China. The decision to pause tariffs for 90 days has sparked optimism among investors, despite an increase in tariffs on Chinese imports to 125%.

Asian Markets React Positively

Leading the charge in Asia, Japan’s Nikkei index surged over 10% at the market open, setting a vibrant tone for the day. By mid-morning, the Nikkei was up 7.38%, while the broader Topix index climbed by 7.12%. Other notable performances included:

- South Korea’s Kospi index: Up 5.4%

- Kosdaq: Increased by 4.61%

- Australia’s S&P/ASX 200 futures: Indicated a promising 7% jump, marking its most significant rise since March 2020.

Interestingly, Hong Kong’s Hang Seng index showed signs of a softer start, contrasting with the buoyant sentiment across the rest of the region.

U.S. Market Breaks Records

On the American front, the stock market experienced its most substantial one-day surge in years. The S&P 500 saw its largest increase since 2008, reflecting a broader market recovery. Key highlights from the U.S. market include:

- The Dow Jones Industrial Average skyrocketed by 2,962.86 points, or 7.87%, finishing at 40,608.45.

- The S&P 500 rose by 474.13 points, or 9.52%, closing at 5,456.90—the highest daily gain since the global financial crisis.

- The Nasdaq Composite soared by 1,857.06 points, marking a 12.16% increase to 17,124.97, the largest leap since the dotcom bubble in January 2001.

- The Russell 2000 Index also enjoyed an 8.66% boost, its biggest jump since March 2020.

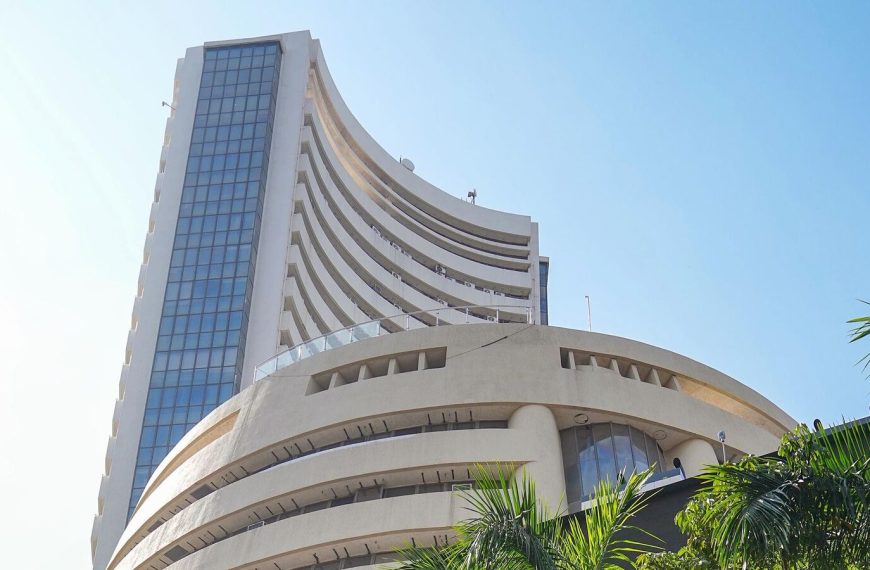

Indian Stock Market Status

In contrast to the global optimism, the Indian stock market will be closed today, April 10, 2025, in observance of Mahavir Jayanti. Trading will be halted across various segments, including:

- Equity

- Equity Derivatives

- SLB Segments

- Currency Derivatives

While the Commodity Derivatives Segment will remain closed for the morning, it will reopen for trading in the evening session.

This compelling market activity signals a cautious yet hopeful sentiment among investors, as global economic dynamics continue to evolve. Stay tuned for further updates as we monitor these developments closely.