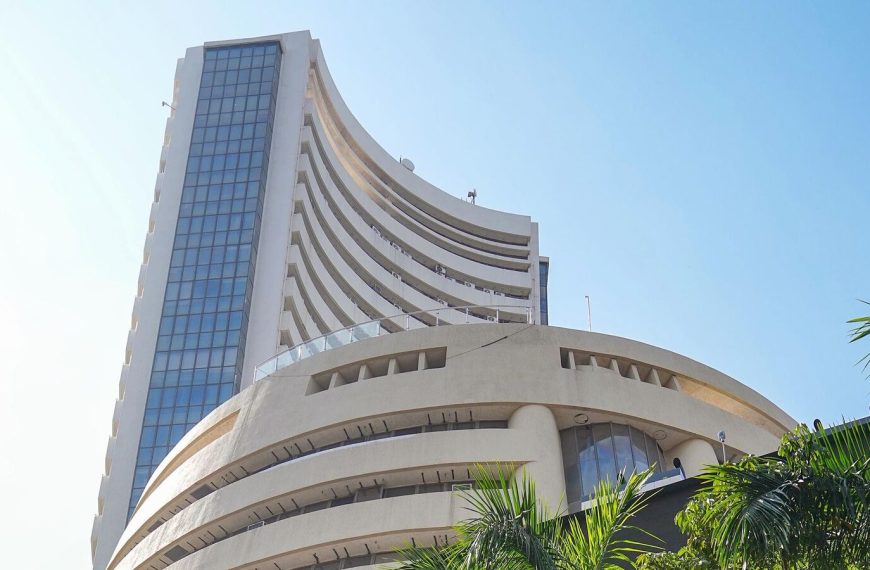

Indian stock markets are closed today, April 14, in observance of Ambedkar Jayanti, while global markets have kicked off the week with positive momentum. Investors are keeping a close watch on various factors, including Wall Street’s performance, crude oil prices, and tariff developments under the Trump administration. Here’s an overview of the global market landscape as Dalal Street takes a breather.

Positive Start in Asian Markets

The Asia-Pacific region experienced a robust opening on Monday, buoyed by easing concerns over U.S. tariffs. Notably, Japan’s Nikkei 225 surged by 1.82%, with the Topix index following closely behind, up 1.77%. South Korea’s Kospi gained 1.29%, and the Kosdaq index rose by 1.22%. Meanwhile, Australia’s S&P/ASX 200 also reported an increase of 0.72% during early trading.

U.S. Futures Show Promise

In the U.S., stock futures are trending upward, with S&P 500 futures increasing by 0.6%, Nasdaq-100 futures climbing 0.9%, and Dow Jones futures rising by 0.3%. This optimism is setting a positive tone for the upcoming trading sessions.

Tariff Relief Boosts Tech Sector

In a significant decision for the technology sector, the U.S. government has opted to exclude electronics such as smartphones, laptops, and hard drives from its latest round of tariffs. This development is a relief for major tech players like Apple and Samsung, who depend heavily on global supply chains. By avoiding additional costs, these companies can maintain competitive pricing on consumer tech products.

Key Highlights:

- U.S. tariffs exclude electronics, benefiting tech companies.

- Major players like Apple and Samsung avoid potential price hikes.

Strong Performance in U.S. Markets

On April 11, the S&P 500 saw a remarkable rise of 1.81%, closing at 5,363.36. The Dow Jones experienced a surge of over 600 points, finishing above the 40,000 threshold. The Nasdaq was the standout performer, climbing more than 2% to end at 16,724.46.

Currency and Commodity Updates

The U.S. Dollar Index (DXY), which assesses the dollar against a basket of six foreign currencies, dipped 0.12% to 99.78. This index includes major currencies like the Euro and Japanese Yen. The Indian rupee also saw a depreciation of 0.75%, closing at 86.05 against the dollar on April 11.

Crude Oil Prices

On Monday, crude oil prices saw a slight uptick, with West Texas Intermediate (WTI) crude trading at $61.64, an increase of 0.23%. Meanwhile, Brent crude edged up by 0.20%, reaching $64.88.

Foreign and Domestic Investment Trends

Foreign Institutional Investors (FIIs) withdrew ₹2,519 crore from Indian equities on April 11, extending a selling streak for nine consecutive sessions. This trend appears to be driven by global uncertainties. However, domestic institutional investors (DIIs) stepped in, purchasing stocks worth ₹3,759 crore, helping to stabilize the market.

Gold Market News

Gold prices took a slight hit on April 14. Following the tariff rollback on Chinese electronics, which eased market tensions, the demand for safe-haven assets like gold diminished. Spot gold fell 0.4% to $3,223.67 per ounce, moving away from its recent peak of $3,245.28. U.S. gold futures also saw a minor dip of 0.1%, trading at $3,240.90.

Indian Market Updates

In India, the MCX will remain closed for morning trading and will reopen for evening trading at 5 PM on April 14.

Corporate Developments to Watch

As the new week unfolds, several companies, including Hexaware Technologies and CRISIL, are set to trade ex-dividend. Hexaware has announced an interim dividend of ₹5.75 per share, with the ex-dividend date scheduled for April 15. CRISIL will go ex-dividend on April 14 for a final dividend of ₹26 per share.

Focus on Earnings and Economic Indicators

Investors are eagerly anticipating quarterly earnings reports from major companies, including Wipro and Infosys, as well as banking giants HDFC Bank and ICICI Bank. Additionally, important economic indicators, such as retail inflation (CPI) and wholesale inflation (WPI), are expected to be released this week, which could significantly impact market sentiment.

As the global markets evolve and Indian investors await critical updates, staying informed will be key to navigating these dynamic financial landscapes.