On April 16, the National Stock Exchange (NSE) implemented a ban on four specific stocks in the futures and options (F&O) trading segment. This action was taken as these stocks exceeded the 95% market-wide position limit (MWPL), which is a threshold designed to ensure fair trading practices. However, investors can still trade these stocks in the cash market, providing some flexibility amidst the restrictions.

NSE’s Latest F&O Ban List

The stocks affected by the recent ban include:

- Birlasoft Ltd

- Hindustan Copper Ltd

- Manappuram Finance Ltd

- National Aluminium Co Ltd

According to the NSE, these stocks have surpassed the designated MWPL, leading to their inclusion in the ban. The exchange has explicitly stated that “All clients/members shall trade in the derivative contracts of said security only to decrease their positions through offsetting positions.” This means that no new positions can be opened during the ban period, and any attempts to do so will face penalties.

Market Performance Insights

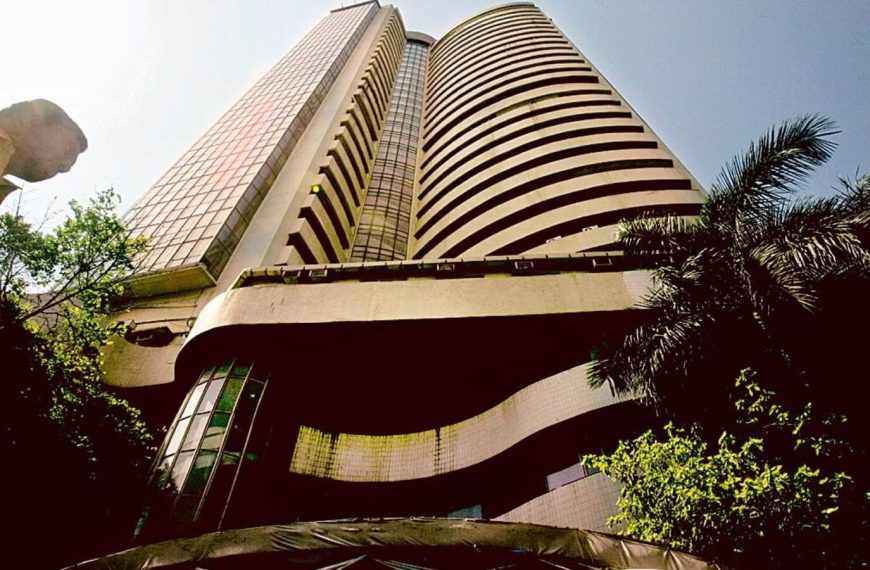

On the day prior, April 15, both the Sensex and Nifty indices saw impressive gains, climbing over 2% as they mirrored positive trends in global markets. This surge followed news of U.S. President Donald Trump easing certain tariffs on electronics and signaling potential adjustments in auto tariffs.

- The BSE Sensex soared by 1,577.63 points, or 2.10%, closing at 76,734.89.

- At its peak during the session, it jumped as much as 1,750.37 points, equating to a 2.32% increase.

Similarly, the NSE Nifty experienced a robust climb, gaining 500 points, which is a 2.19% increase, settling at 23,328.55. During the day, it even reached 23,368.35, reflecting a 2.36% rise.

Top Gainers in the Market

Among the stars of the trading day, IndusInd Bank led the charge with an impressive gain of 6.84%. Other notable performers included:

- Tata Motors: Up 4.50%

- Larsen & Toubro

- Axis Bank

- Adani Ports

- HDFC Bank

- ICICI Bank

- HCL Tech

These gains are a clear indication of the market’s recovery from the previous downturn triggered by Trump’s tariffs announced on April 2. The recent uptick suggests a renewed investor confidence and a rebound in trading activity.

In summary, while the NSE’s ban on specific stocks may pose challenges for traders in the F&O segment, the overall market is experiencing a robust recovery, suggesting potential opportunities for investors.