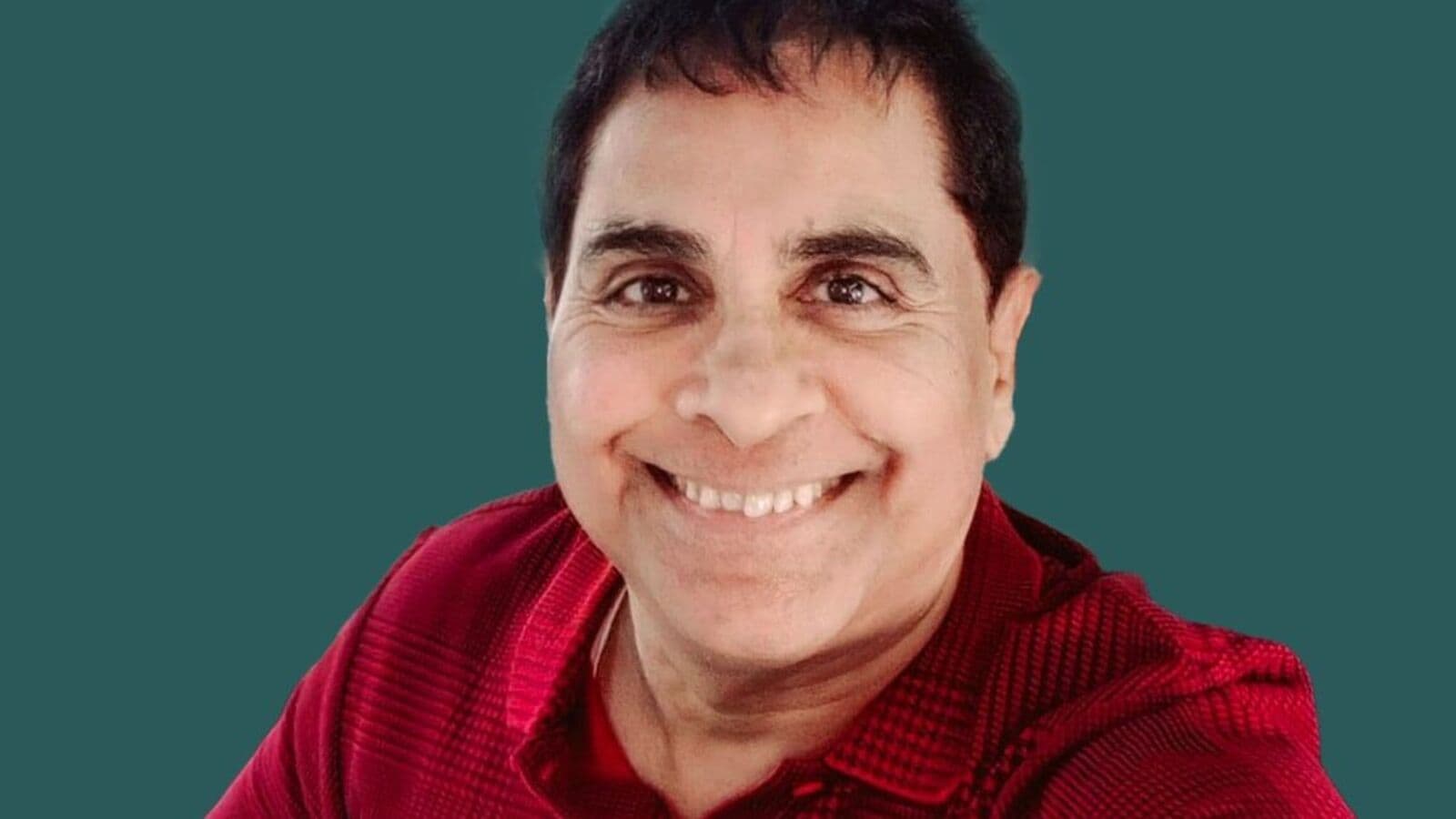

Renowned investor Vijay Kedia has made headlines recently for his strategic maneuvers in the stock market, particularly with Global Vectra Helicorp. During the first quarter of 2025 (Q4 FY25), Kedia offloaded 30,000 shares of this small-cap stock, indicating a calculated profit-taking decision. According to the latest shareholding updates, Kedia’s firm, Kedia Securities, reported holding 259,782 shares, amounting to a 1.86% stake in the company as of March 2025.

Kedia’s Investment Strategy

Vijay Kedia’s investment tactics have long been a subject of fascination among market watchers. In the previous quarter, ending December 2024, Kedia maintained a larger position with 289,782 shares, translating to a 2.07% stake. Furthermore, Kedia personally held 419,436 shares, representing a 3% stake in Global Vectra during the same period.

- Current Shareholding:

- March 2025: 259,782 shares (1.86% stake)

- December 2024: 289,782 shares (2.07% stake)

- Personal Holding: 419,436 shares (3% stake)

Global Vectra’s Performance

Global Vectra Helicorp has shown impressive growth, boasting a market capitalization of ₹337 crore. Over the past year, this stock has skyrocketed by 59%, significantly outperforming the BSE Sensex, which has remained relatively stagnant.

- Performance Highlights:

- 1-Year Increase: 59%

- 2-Year Growth: 343%

- 3-Year Growth: 328%

- 5-Year Growth: 445%

This remarkable upward trend showcases the potential of small-cap stocks, making Global Vectra a noteworthy consideration for investors.

Earnings Insight

Despite its impressive stock performance, Global Vectra faced challenges in its earnings report for Q3 FY25. The company recorded a loss of ₹2.99 crore, a stark contrast to the profit of ₹3.37 crore reported in the same quarter the previous year. However, it’s worth noting that this loss has narrowed from ₹4.15 crore in the preceding quarter.

- Revenue Performance:

- Q3 FY25 Revenue: ₹142.57 crore (10% YoY increase)

- Q3 FY24 Revenue: ₹125.98 crore

As Vijay Kedia continues to navigate the complexities of the stock market, his actions in Global Vectra Helicorp serve as a reminder of the dynamic nature of investments and the potential rewards associated with small-cap stocks. Investors keen on discovering promising opportunities may want to keep an eye on Kedia’s portfolio movements and Global Vectra’s evolving performance.