In a recent statement, President Donald Trump hinted at the possibility of granting exemptions to his 10% tariff on most U.S. trading partners. While he acknowledged that this rate is “pretty close” to being a baseline for countries looking to negotiate trade agreements, he left the specifics of these “obvious reasons” for exceptions unclear. Speaking to reporters aboard Air Force One, Trump emphasized that the tariff remains a significant component of his economic strategy.

Market Reactions and Economic Uncertainty

This announcement comes on the heels of a chaotic week for both equity and bond markets. Investors and businesses are left grappling with the implications of Trump’s evolving trade policies. Earlier in the week, the president implemented aggressive tariffs on numerous nations but quickly backtracked after witnessing the financial markets react negatively. Concerns mounted that his import taxes could severely impact the global economy.

- China, the second-largest economy worldwide, is facing an astonishing 145% tariff.

- Despite this, Trump is maintaining the baseline 10% rate for most countries, as foreign governments scramble to finalize trade agreements.

On Friday, the stock market rebounded, marking its most successful week since 2023. The S&P 500 surged by 1.8%, buoyed by reports that a Federal Reserve official signaled readiness to stabilize the markets if necessary. Meanwhile, U.S. 10-year Treasury yields experienced their largest weekly increase in over 20 years.

Growing Concerns Amidst Tariff Strategies

The ongoing volatility reflects rising fears that Trump’s aggressive tariff approach could drive economies toward recession, jeopardizing the U.S.’s status as a global economic safe haven. However, Trump remains optimistic. “I think the markets were solid today. I think people are seeing we’re in great shape,” he asserted, reinforcing his belief in the resilience of the U.S. dollar.

He further stated, “If a nation said we’re not going to be on the dollar, I would tell you that within about one phone call they would be back on the dollar.” This underscores his conviction that the dollar will continue to be the preferred global currency.

China’s Response and Future Trade Relations

In retaliation, Beijing increased tariffs on all U.S. goods to 125%, matching the White House’s recent tariff hikes on Chinese imports. This escalation comes alongside a commitment from China to “fight to the end” against further tariff increases, although specific countermeasures remain unspecified.

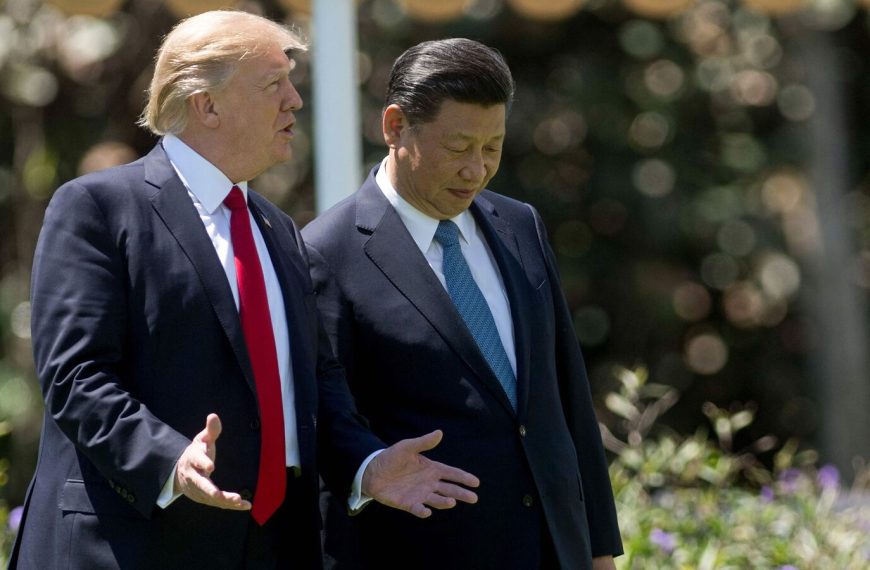

“I think something positive is going to come,” Trump remarked when asked about the ongoing trade conflict with China. He referred to Chinese President Xi Jinping as “a very good leader, a very smart leader,” indicating his hope for a resolution despite current tensions.

As the situation unfolds, both markets and stakeholders are left to navigate the complexities of Trump’s tariff policies and their far-reaching implications for global trade relations.