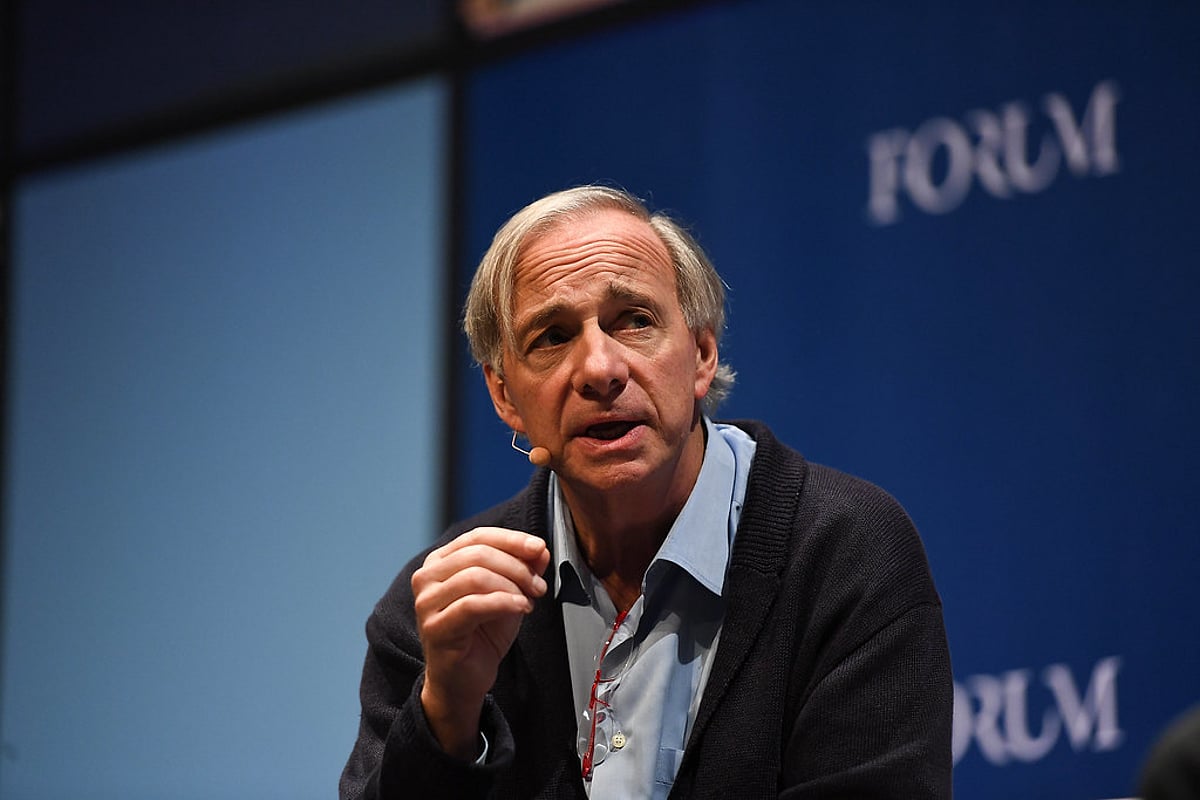

Billionaire investor Ray Dalio has a stark warning for those fixated on the latest U.S. tariffs: the bigger issue is being overshadowed. As the co-chief investment officer of Bridgewater Associates, the largest hedge fund globally, Dalio believes we are on the brink of a significant shift that’s reshaping international relations and financial stability.

The Bigger Picture: A Breakdown of Global Systems

In a recent post on X, Dalio highlighted that we are witnessing a profound breakdown of essential monetary, political, and geopolitical systems. While the announcement of new tariffs grabs headlines, Dalio asserts that these changes are merely the symptoms of deeper, systemic issues.

- Key Forces at Play: Dalio identifies five critical forces that are converging:

- Unsustainable national debt

- Political fragmentation

- Decline of U.S. global leadership

- Climate change impacts

- Rapid technological advancements, particularly in AI

Dalio emphasizes the interaction among these forces, warning that overlooking their connections could lead to a misunderstanding of the broader historical cycle that has historically reshaped empires.

Understanding the Consequences of Tariffs

While the media focuses on the immediate ramifications of tariffs, it’s essential to consider the underlying factors that led to these decisions. Dalio pointed to former President Donald Trump’s tariff policies as an example of how one significant event can trigger a cascade of effects across all five identified forces, destabilizing markets, heightening political division, and eroding global trust.

“This type of breakdown is a rare occurrence,” Dalio noted. “But history shows that similar conditions have led to significant upheaval before.”

Learning from History

Dalio urges investors and policymakers to examine historical parallels to better navigate the current landscape. He suggested that past strategies—such as suspending debt payments, implementing capital controls, and introducing special taxes—might resurface as viable options during periods of extreme stress.

His call to action is clear: don’t just observe the surface-level events; delve into the reasons behind them, their connections, and the potential future implications.

In a time when the focus is on tariffs and their immediate effects, it’s crucial to look beyond and grasp the larger forces at work. Understanding these dynamics can provide valuable insights into navigating the complexities of our evolving global order.