India’s Unique Position in Global Trade

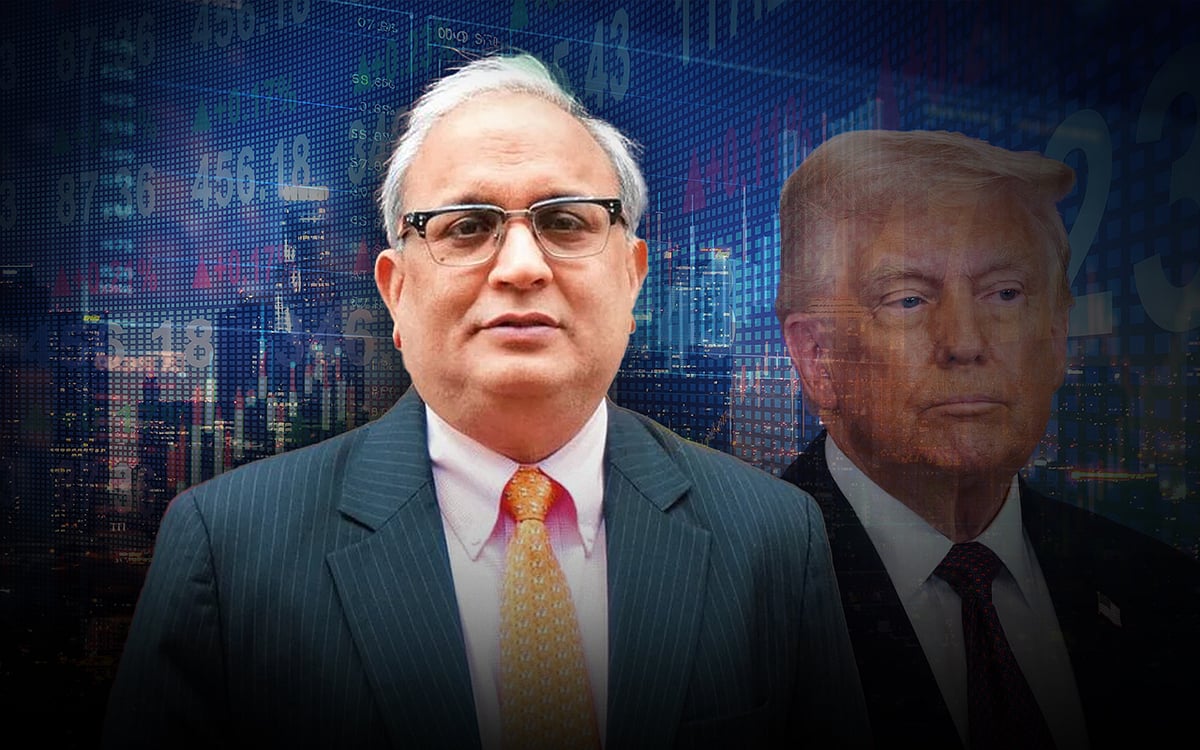

In the ever-evolving landscape of global trade, India is emerging as a surprising player, especially in light of recent tariff decisions by the United States. Samir Arora, the founder of Helios Capital Singapore, highlights how India’s lower exposure to international trade might actually work to its advantage. This unique position could provide India with a competitive edge in the global market.

Tariff Impacts on India’s Trade Dynamics

According to Arora, the tariffs imposed by President Donald Trump could have a mixed impact globally, but for India, the situation appears favorable. The country’s relatively low trade exposure means it is less affected by these tariffs.

- Value Addition: India often enhances the value of imports, converting raw materials into finished products before exporting them.

- Reduced Import Figures: This process results in lower overall import numbers, which could be a point of consideration for U.S. trade officials.

Strategic Advantages in International Trade

India’s strategy of focusing on value addition rather than raw material exports gives it a unique leverage.

- Final Goods Exporting: By exporting finished goods, India positions itself as a crucial player in various supply chains.

- Resilience in Trade: This resilience could protect the country from the adverse effects of external trade policies.

In conclusion, while global trade dynamics continue to shift, India’s approach may allow it to navigate challenges effectively. As Arora suggests, this could encourage a more favorable view from U.S. officials amid ongoing trade discussions. The future of India’s role in international trade remains promising, bolstered by its strategic advantages and lower exposure to external shocks.