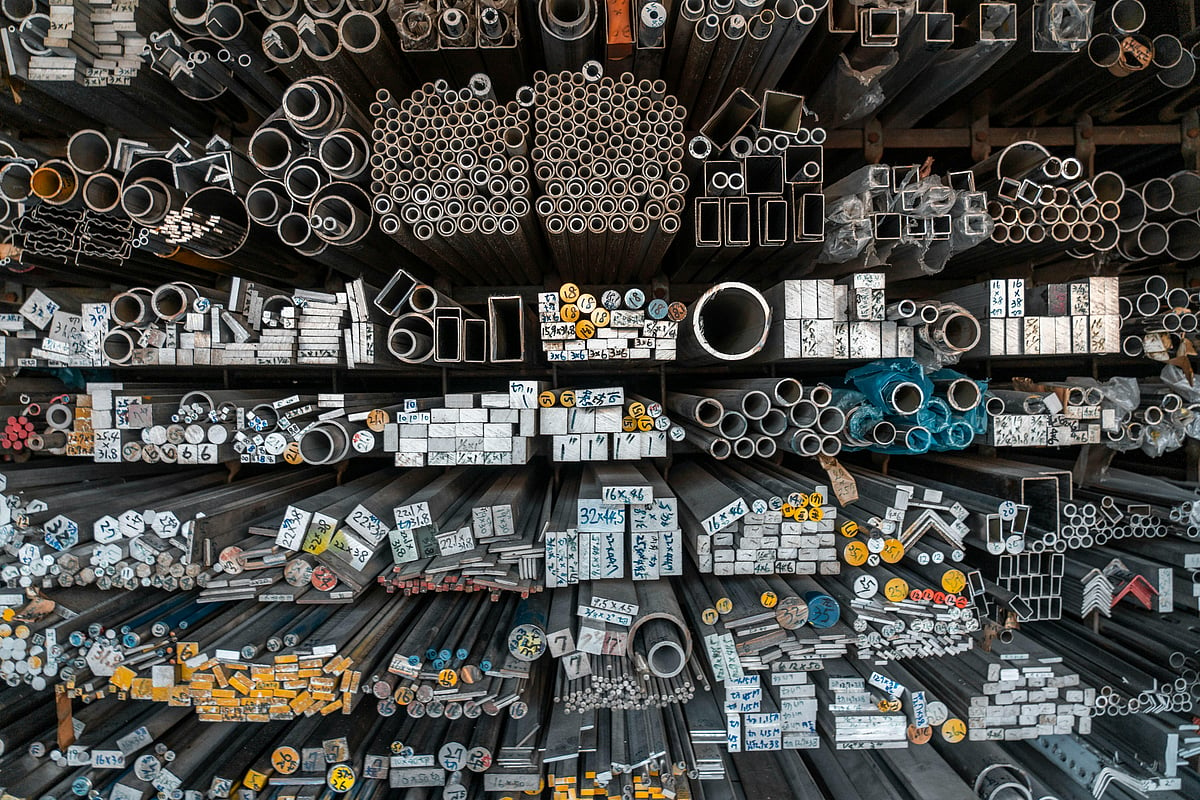

The recent fluctuations in the Indian metal market have drawn attention, particularly after the announcement of the U.S. tariffs on steel and aluminum. While the direct effects of these tariffs may seem minimal, the ripple effects are raising concerns among investors. On Friday, the Nifty Metal Index experienced a significant drop of 4.8%, reflecting the growing apprehension regarding future commodity pricing and economic conditions.

Limited Direct Impact of U.S. Tariffs

The tariffs imposed by the U.S. on Indian steel and aluminum exports have not had a substantial direct impact, primarily because India exports a limited quantity of these metals to the U.S. However, the broader implications are where the concern lies. Analysts at Emkay Research suggest that the real threat comes from potential second-order effects that may adversely affect the Indian metal sector.

The Risk of Indirect Consequences

Despite the limited direct trade impact, the indirect consequences could be troubling. As global brokerages analyze the situation, the likelihood of a U.S. recession has increased dramatically. For instance, Goldman Sachs has adjusted its recession probability to 35%, while JP Morgan has raised it to 40%. This heightened risk of an economic downturn in the U.S. could lead to a sharp decline in global commodity prices, including metals.

- Key Points:

- Nifty Metal Index fell by 4.8% in intraday trading.

- U.S. tariffs on Indian metals have minimal direct impact due to low export volumes.

- Potential recession in the U.S. raises fears of falling commodity prices.

- Goldman Sachs and JP Morgan report increased recession probabilities.

Implications for Indian Metal Producers

The Indian metal industry, which plays a vital role in the FY26 Nifty EPS, is now facing vulnerabilities. As new production capacities are set to come online, the risk of lower metal prices could jeopardize the earnings of major players such as Vedanta, Hindalco, and Nalco. Market analysts are closely monitoring these developments, as the potential for earnings decline looms large.

In conclusion, while the immediate impact of U.S. tariffs on Indian steel and aluminum exports may be negligible, the potential indirect repercussions paint a more concerning picture. Investors should remain vigilant as the global economic landscape continues to evolve, with the Nifty Metal Index caught in the crosshairs of these shifts.