The stock market is experiencing turbulence, following a significant announcement from U.S. President Donald Trump regarding a Reciprocal Tariff. This decision has sent shockwaves through the financial world, leading to a sharp selloff in U.S. markets and raising recession concerns globally. Major indices such as the Dow Jones, S&P 500, and Nasdaq suffered their largest single-day declines in five years. As a result, Asian markets are mirroring this downturn, with U.S. stock futures also under pressure.

Market Overview: Cautious Beginnings

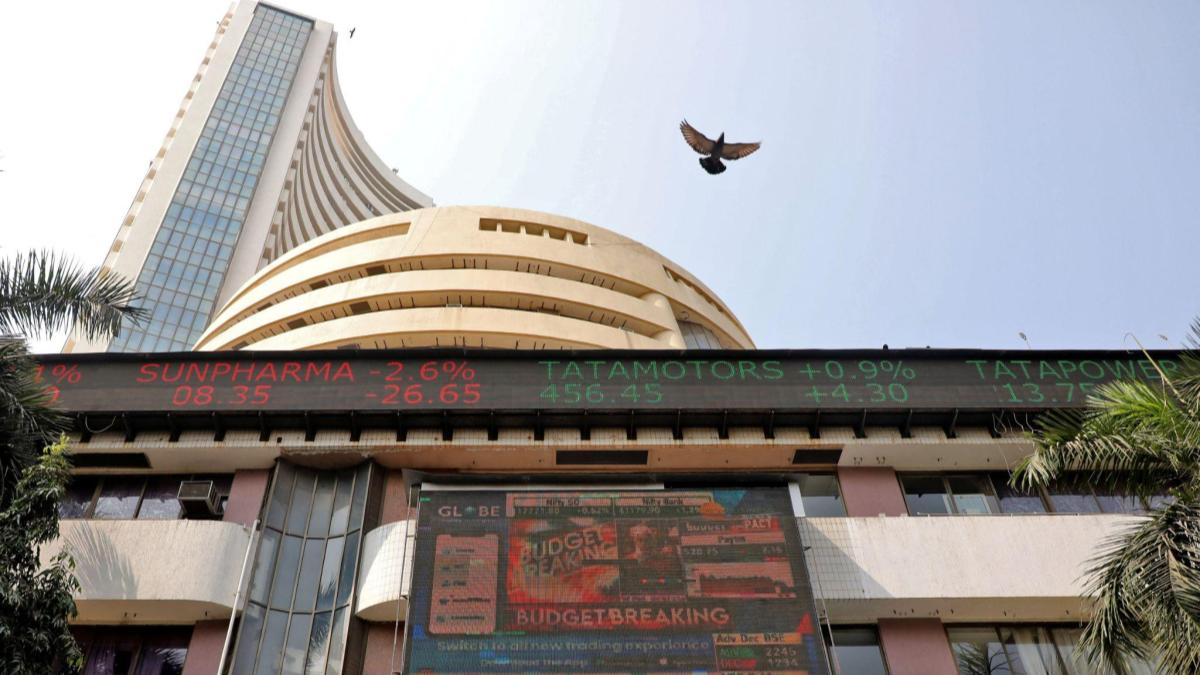

In early trading, the GIFT Nifty is showing signs of a cautious start for the Indian markets, trading slightly lower. However, Indian investors had shown resilience in the previous session, contemplating the impact of the newly imposed 26% tariff on imports.

Wall Street’s Reaction to Tariff Shocks

On Thursday, April 3, 2025, Wall Street faced its most challenging day since 2020, tumbling sharply in response to President Trump’s tariff announcement. This drastic move raised alarms about a potential global trade war and economic recession, pushing the S&P 500 into correction territory. The Dow experienced a significant drop, while the tech-heavy Nasdaq recorded the steepest fall of the day.

Impact on Indian Stock Markets and Key Sectors

The Indian stock market reacted with caution, reflecting the declines seen in major indices. Notably, the IT sector was hit particularly hard, experiencing its steepest drop in years due to fears of diminished business demand from the U.S. Conversely, pharmaceutical stocks showed resilience, benefiting from tariff exemptions.

Global Responses and Possible Retaliations

Governments around the world are voicing strong opposition to the tariffs, with major trading partners like the European Union, China, and Canada considering retaliatory measures. Diplomatic negotiations are expected to ramp up in the coming weeks as countries navigate this economic turbulence.

Market Insights: Navigating Uncertainty

- Bank Nifty managed to absorb the impact of the tariff announcement and saw a slight uptick, although uncertainty still looms large.

- Traders are closely monitoring global reactions, especially from China, as the potential for a trade war could escalate, affecting market stability.

- Analysts suggest targeting Nifty at 22,700 and Bank Nifty at 49,500, with a bearish outlook on M&M Financial due to its technical patterns.

Key Stocks to Watch

Several companies are capturing investor attention today, including:

- UltraTech Cement

- Jio Financial

- Avenue Supermarts

- Nestle India

- Fortis Healthcare

- Jupiter Wagons

- Paras Defence

- RBL Bank

- Vedanta

- HDFC Bank

- Bajaj Finance

Oil Market Update

Following Trump’s tariff announcement, oil prices have taken a significant hit. This comes on the heels of OPEC+ deciding to speed up output increases, leading to the most substantial oil price drop since 2022. As of April 4, WTI crude has decreased by 0.58% to $66.56 per barrel, while Brent crude has slipped 0.52% to $69.78.

Asian Markets and Regional Sentiment

Asian stock markets continued to decline, reflecting the losses on Wall Street. The Nikkei 225 in Japan fell by 2.07%, while the broader Topix index dropped 2.69%. Australia’s S&P/ASX 200 lost 1.06%, and South Korea’s Kospi shed 1.15%, with market jitters remaining high across the region.

Conclusion: Stay Informed

As markets react to evolving global dynamics, staying updated on market trends and economic developments is crucial. For real-time updates and insights, follow our live blog, where we provide the latest news every 20 minutes.