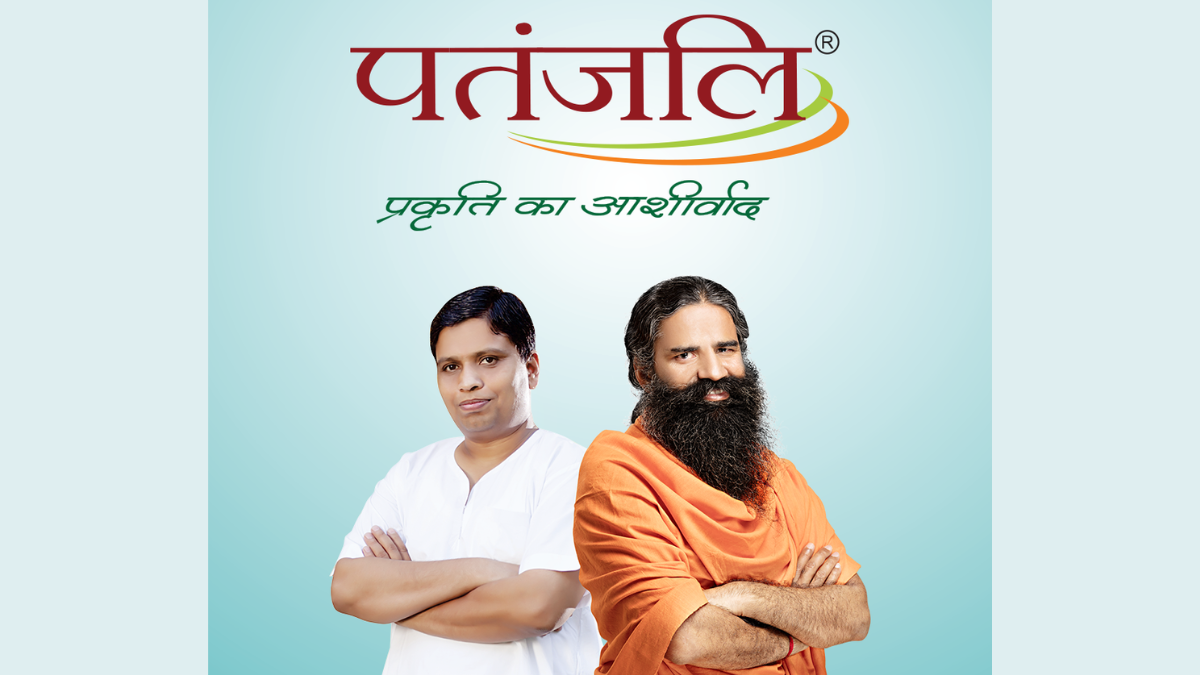

Baba Ramdev’s Patanjali Ayurved has taken a bold step by acquiring a majority stake in Magma General Insurance, marking its entry into the dynamic world of general insurance. This strategic move not only diversifies Patanjali’s offerings but also positions it to compete in a sector traditionally dominated by established players. With this acquisition, Patanjali aims to broaden its business reach beyond its well-known Ayurvedic and wellness products, as reported by CNBC TV18.

Patanjali’s Ambitious Expansion

By becoming the promoter of Magma General Insurance, Patanjali Ayurved is set to transform the Indian insurance market. This acquisition reflects the company’s commitment to expanding its business operations and entering new sectors. As Patanjali ventures into insurance, it aims to leverage its brand recognition and customer loyalty to gain a foothold in this competitive landscape.

Key Players in the Transaction

The acquisition involved several noteworthy stakeholders, with Senoti Properties being a prominent seller. This joint venture, associated with businessman Adar Poonawalla and Rising Sun Holdings, previously held a 74.5% stake in Magma General Insurance. The deal also saw participation from other sellers, including:

- Celica Developers

- Jaguar Advisory Services

- Keki Mistry

- Atul DP Family Trust

- Shahi Sterling Exports

- QRG Investments & Holdings

Implications for the Insurance Sector

The entrance of Patanjali into the insurance realm signals a shift in the market dynamics. With its robust distribution network and a loyal customer base, Patanjali is poised to make significant inroads into general insurance. This move not only reflects the company’s growth strategy but also its ambition to innovate within the insurance space.

As Baba Ramdev continues to advocate for Indian products and services, this new venture could further the goal of providing affordable and holistic insurance solutions to the Indian populace.

Conclusion

Patanjali Ayurved’s acquisition of Magma General Insurance is a significant milestone that showcases its ambition to diversify and expand its business portfolio. By entering the competitive insurance market, Patanjali is not only aiming to reshape its future but also potentially change the landscape for consumers seeking reliable insurance solutions. This strategic move is one to watch as it unfolds in the coming months.