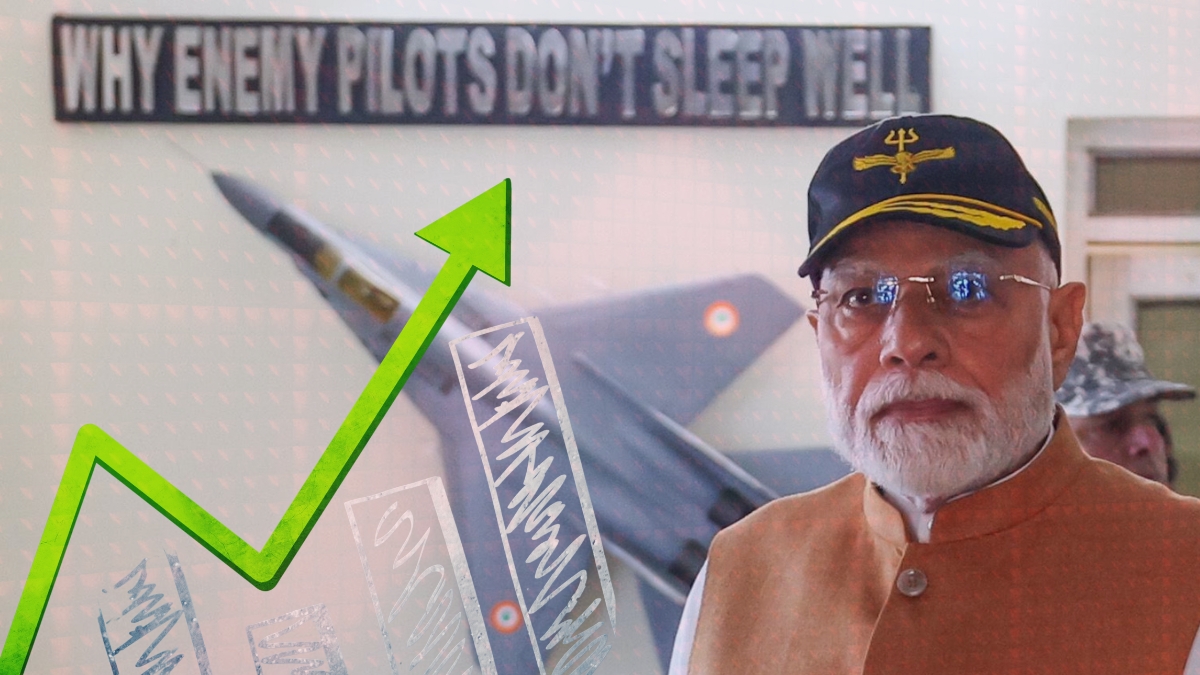

Indian defense stocks are experiencing an impressive surge, capturing the attention of investors. On Tuesday, share prices soared following Prime Minister Narendra Modi’s strong endorsement of ‘Made in India’ military technology. This initiative aims to establish India as a self-sufficient defense powerhouse, igniting optimism in the sector.

Significant Gains for Key Defense Stocks

Among the standout performers, Bharat Dynamics saw its share price leap by an impressive 9.4%, reaching ₹1,718 on the National Stock Exchange.

- Bharat Electronics, recently included in the Nifty 50, also had a remarkable day, with its shares climbing 4.6% to an intra-day peak of ₹337.75.

- Hindustan Aeronautics followed suit, with a 4.6% rise, trading at ₹4,645.

Additionally, several other defense-related firms like Kaynes Technology, Cochin Shipyard, Mazagon Dock Shipbuilders, Avantel, Paras Defence & Space Technology, Astra Micro, and Data Patterns also witnessed notable increases.

Modi’s Vision for Self-Reliance in Defense

The recent rally in defense stocks is largely attributed to PM Modi’s emphatic call for indigenous defense capabilities. He emphasized the necessity for India to lead in defense innovation and technology, reinforcing the nation’s commitment to overcoming reliance on foreign military supplies.

During a nationwide address following Operation Sindoor, which was a response to the tragic Pahalgam terrorist attack that claimed 26 lives on April 22, Modi stated, “India has proven its prowess in modern warfare and must now champion ‘Made in India’ defense solutions.” His remarks highlighted India’s capability in contemporary military engagements and the importance of self-reliance in defense.

Highlights from Operation Sindoor

Operation Sindoor marked a significant military response, during which the Indian armed forces successfully targeted and neutralized threats posed by Pakistan’s military. The operation showcased advanced technology with the downing of enemy aircraft and the destruction of critical military infrastructure near Islamabad.

- India effectively countered missile and drone threats from Pakistan.

- Strategic strikes were executed against terror camps located in Pakistan and Pakistan-Occupied Kashmir.

As the defense sector continues to gain momentum, investors and analysts alike are optimistic about the future of India’s military capabilities and the potential for increased domestic production of defense equipment. With PM Modi’s vision firmly in place, the focus on innovation and self-sufficiency is set to propel the industry forward.