BEML Shares Surge Following Key Land Acquisition in Madhya Pradesh

In a significant move for the defense and construction sectors, BEML Ltd. experienced a remarkable 4.5% increase in its stock price. This surge comes on the heels of the company’s announcement regarding a strategic land acquisition in Madhya Pradesh aimed at expanding its operations. Investors are keenly watching this development, especially in light of rising demand driven by the recent India-Pakistan tensions.

Strategic Expansion Plans

BEML, a prominent player in the defense, aerospace, rail, and mining sectors, has set its sights on a new construction project. The land acquisition, officially reported on the National Stock Exchange of India and the Bombay Stock Exchange on May 11, 2025, involves approximately 148 acres in Umeria, Raisen District. This facility will focus on manufacturing rolling stock and coaches for railway and metro initiatives, showcasing BEML’s commitment to enhancing infrastructure in the region.

- Land Size: 60.063 hectares (about 148 acres)

- Location: Umeria, Raisen District, Madhya Pradesh

- Purpose: Construction of railway and metro coaches

Growing Investor Confidence

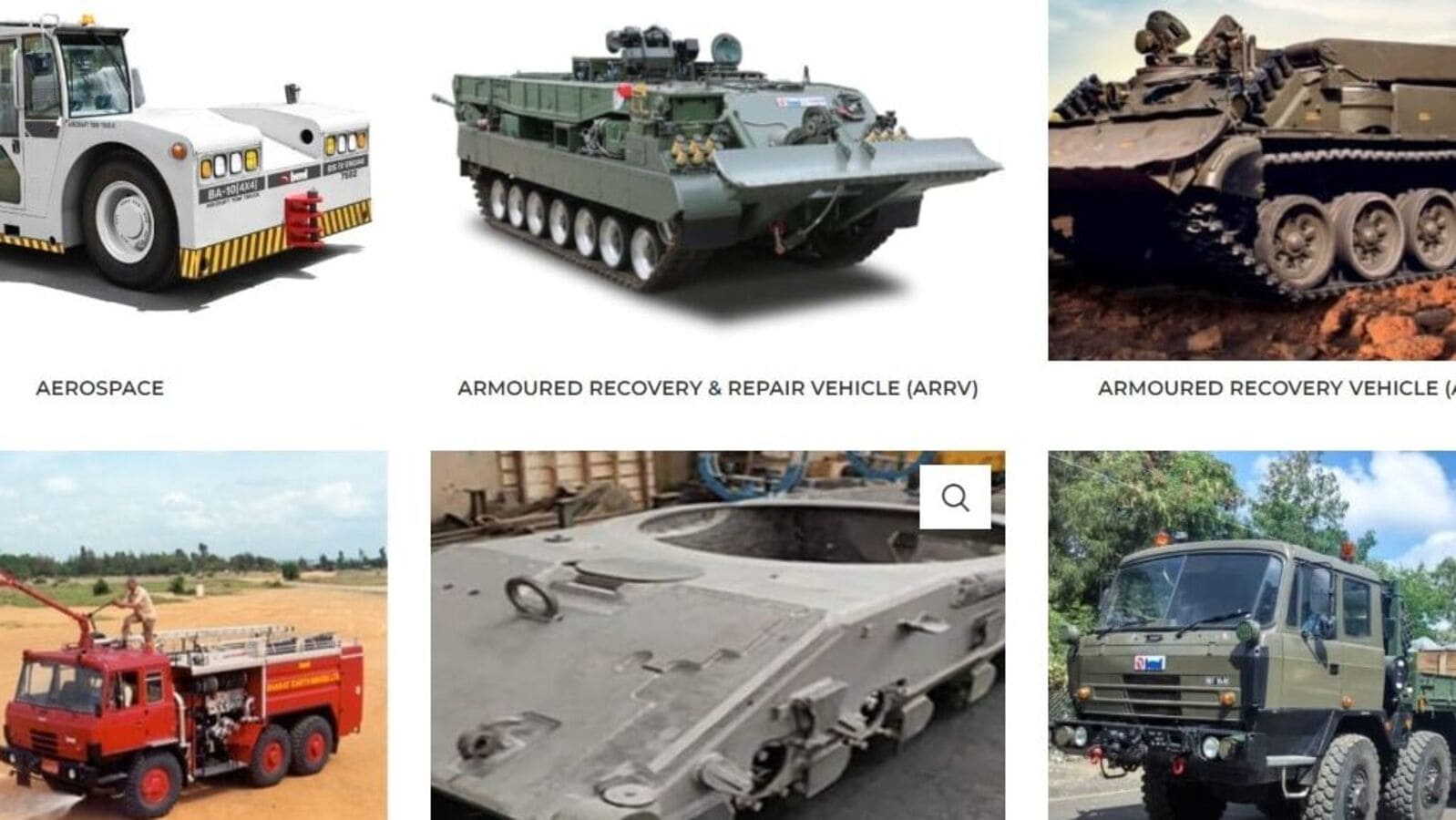

With the ongoing geopolitical situation, particularly the recent conflicts between India and Pakistan, the demand for defense equipment is expected to surge. This anticipated increase in requirements has bolstered investor confidence in BEML’s growth trajectory. The company’s diverse portfolio includes critical defense vehicles such as:

- Bridge Layers

- Medium & Heavy Recovery Vehicles

- Mobile Mast Vehicles

- Crash Fire Tenders

These products are designed for a variety of terrains, underscoring BEML’s adaptability and expertise in the defense sector.

BEML Stock Performance

On Monday, BEML shares opened at ₹3178.95 on the BSE, representing a 3.9% increase from the previous day’s close of ₹3058.65. The stock continued its upward momentum, reaching an intraday high of ₹3195, which effectively marked a gain of nearly 4.5%. This positive movement reflects strong market sentiment and the strategic initiatives BEML is undertaking.

Conclusion

As BEML embarks on this ambitious expansion in Madhya Pradesh, investors are optimistic about the company’s future. The combination of rising defense needs and new infrastructure projects positions BEML for potential growth in the coming years. Keep an eye on this stock as developments unfold, especially in the context of evolving defense strategies in the region.

For more insights on market trends and stock performances, be sure to check out our latest articles on investment strategies.