The Indian stock market concluded the week on a high note, despite experiencing ups and downs throughout the trading day. The Sensex closed at 80,501.99, reflecting a 0.32% increase after a remarkable surge of nearly 900 points earlier in the session. Similarly, the Nifty 50 ended slightly higher at 24,346.70, marking a gain of 0.05%. The Nifty Bank index also saw a modest rise, closing at 55,115.35, which was an uptick of 0.05%.

Market Volatility and Investor Sentiment

The session was marked by noticeable volatility, as indicated by the India VIX, the benchmark for market anxiety, which finished at 18.26, climbing 0.19%. This volatility suggests that investors were cautious but optimistic about future market movements.

Key Highlights from the Trading Day

Here are the essential takeaways from Friday’s trading session:

-

Top Gainers:

- Adani Ports

- Bajaj Finance

- IndusInd Bank

- SBI

- Hindalco

- Major Losers:

- JSW Steel

- Bajaj Auto

- Eicher Motors

- HDFC Life

- Hero MotoCorp

Positive Manufacturing Data

In a promising sign for the economy, the HSBC India Manufacturing PMI rose to 58.2 in April 2025, up from 58.1 in March. This marks the highest growth rate in manufacturing activity in the last 10 months, fueled by robust domestic and international demand, with production escalating at its fastest rate since June 2024.

Mixed Performance in IT Stocks

The Nifty IT index exhibited a mixed performance, with some stocks performing well. Notable gainers in this sector included Persistent Systems, Coforge, and HCL Tech. In contrast, companies like Tech Mahindra, TCS, and Oracle Financial Services experienced minor declines.

Additional Reading: For a deeper dive, check out the Supreme Court’s recent decision regarding JSW Steel’s resolution plan for Bhushan Power and Steel.

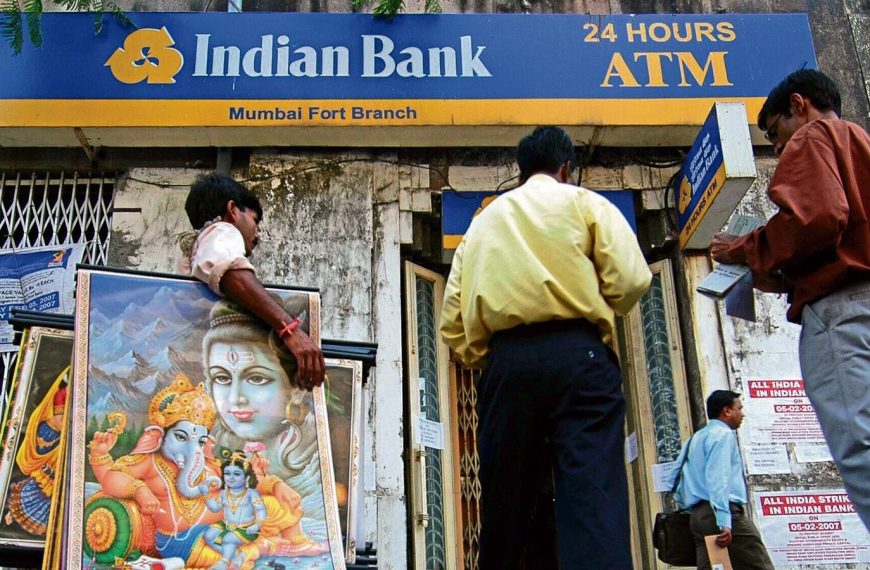

Banking Sector Drives Market Upward

The banking sector was pivotal in driving the indices upward. Major players such as ICICI Bank, HDFC Bank, and Axis Bank registered significant intraday gains. The Nifty Bank index surged over 1% during the session, continuing its bullish trend from March and April, where it had already climbed nearly 7%.

Indian Rupee Strengthens Against the Dollar

In currency news, the Indian rupee strengthened, surpassing the 84 per dollar mark for the first time since October 2024. This shift reflects a positive sentiment towards the Indian economy and may influence future market movements.

In summary, despite a day of volatility, the Indian stock market displayed resilience, with key sectors showing growth and promising economic indicators paving the way for optimism among investors.