In a recent social media post, Harsh Goenka, the Chairman of RPG Enterprises, shared a thought-provoking comparison about the value of gold versus other assets that lose value over time. His reflections, posted on X (formerly Twitter), highlight the significant differences in appreciation between gold and items like cars, vacations, and smartphones.

Gold vs. Depreciating Assets

Goenka offered a personal anecdote to illustrate his point. Ten years ago, he purchased a car for ₹8 lakh, while his wife invested the same amount in gold. Today, that vehicle has plummeted in value to just ₹1.5 lakh, while the gold has soared to an impressive ₹32 lakh.

- 10 years ago:

- Car: ₹8 lakh → Today: ₹1.5 lakh

- Gold: ₹8 lakh → Today: ₹32 lakh

In his post, he remarked, “I bought a car for ₹8 lakh, and my wife chose gold instead. The car is worth ₹1.5 lakh now, but her gold? That’s worth ₹32 lakh.”

The Value of Experience vs. Wealth

Goenka also recounted a conversation with his wife regarding the merits of spending on experiences like vacations instead of investing in gold. He suggested they skip the gold purchase for a getaway, but his wife countered with wisdom: “Vacations are fleeting, but gold has the potential to create generational wealth.” This exchange underscores the importance of long-term investment in assets that appreciate over time.

Smart Investments: A Lesson Learned

In another personal story, Goenka compared the depreciation of a smartphone he bought for ₹1 lakh, which now stands at a mere ₹8,000, against his wife’s gold investment that is currently valued at ₹2 lakh. He humorously concluded with the moral, “Wives are smarter.”

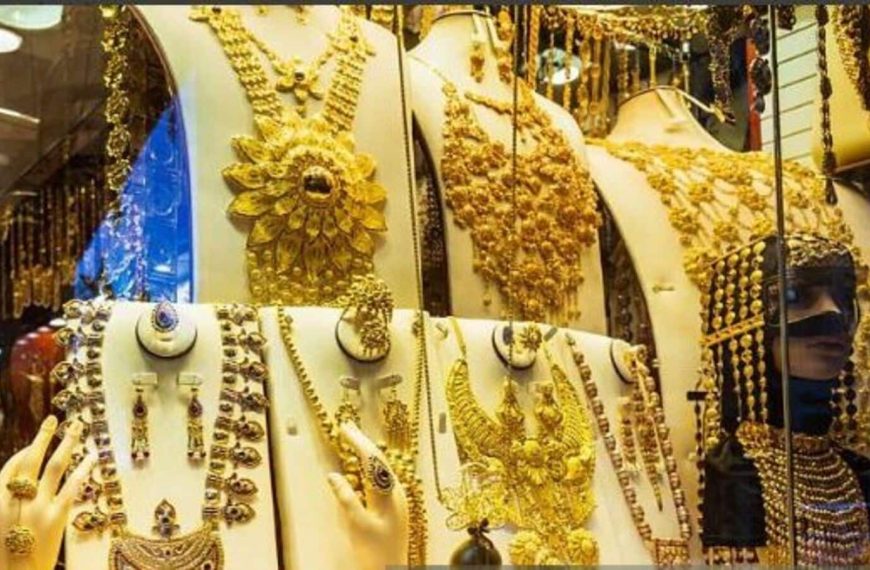

Current Gold Market Trends

On April 23, the gold market experienced a notable downturn. The Gold Futures for the June 2025 contract fell 2.22%, dropping ₹2,162 to ₹95,178 per 10 grams on the Multi Commodity Exchange (MCX). This decline follows a series of gains in previous sessions, highlighting the volatility often associated with gold prices.

Gold Price Forecast

Jateen Trivedi, VP of Research at LKP Securities, provided insights into the current market, indicating a potential short-term trend reversal following recent peaks. He noted that April is typically a volatile month for gold prices, forecasting a range between ₹94,000 to ₹98,000 amidst this instability.

- Recent gold price movements:

- Declined by ₹1,500, settling at ₹95,800

- Intraday low reached ₹94,950

Trivedi further explained that a rebound in the Dollar Index and comments hinting at tariff resolutions may have contributed to gold’s declining safe-haven premium. As concerns over tariffs ease, the market may experience further adjustments.

In summary, the contrasting values of gold and other depreciating assets serve as a compelling reminder of the importance of smart investment choices. As volatility continues in the gold market, investors are encouraged to practice diligent risk management during these fluctuating conditions.