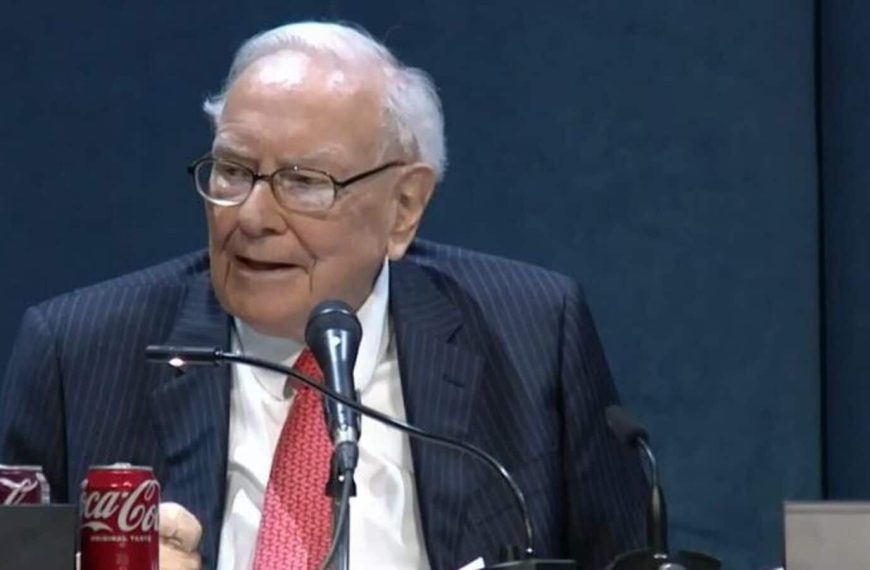

Berkshire Hathaway recently announced the date for its highly anticipated 2025 Annual Shareholders Meeting, scheduled for May 3, 2025. This event, overseen by the legendary Warren Buffett, will be crucial as it will include discussions around the company’s first-quarter financial results for the year. Investors and analysts alike are eager to see what insights Buffett will share about the current economic climate and Berkshire’s performance.

Key Details About the Meeting

The 2025 Annual Shareholders Meeting will commence with a Q&A session featuring Berkshire’s leadership, including Buffett, Greg Abel (Vice Chairman of Non-Insurance Operations), and Ajit Jain (Vice Chairman of Insurance Operations). This interactive session is set to begin at 8:00 AM Central Time, while the broadcast will start at 7:30 AM Central Time on CNBC and will also be available online at CNBC.com.

- Date: May 3, 2025

- Q1 Earnings Release Time: 7:00 AM Central Time

- Q&A Session Start: 8:00 AM Central Time

- Broadcast: Available on CNBC and CNBC.com

Anticipation Surrounding Q1 Results

As Berkshire Hathaway prepares to unveil its Q1 earnings, Wall Street is particularly interested in how Buffett will address ongoing economic uncertainties, including the effects of tariffs introduced during the previous administration. This meeting marks a notable milestone, as it celebrates Buffett’s incredible 60-year tenure leading the company, which has evolved into a $1.15 trillion powerhouse.

During this comprehensive 4.5-hour session, Buffett is expected to tackle a broad range of topics, from the company’s diverse operations—including Geico, BNSF, and Dairy Queen—to reflections on his personal investment philosophies and the future of the conglomerate after his eventual departure.

Insights on Berkshire Hathaway’s Financial Health

Investors will closely monitor several key areas during the meeting:

-

Adjusted Q1 Earnings Per Share: Analysts anticipate a modest decline in earnings per share, projected to drop from $5.20 to $4.72 year-over-year. Observers are curious whether Berkshire can exceed these expectations as it has done in the past.

-

Stock Portfolio Performance: Berkshire’s holdings are significantly impacted by major U.S. stocks like Apple, Coca-Cola, and Amazon. Shareholders will be keen to hear updates on these giants during Buffett’s insights.

-

Cash Reserves Overview: With a staggering $300 billion in cash reserves, investors are eager for the latest updates on how these funds might be allocated, particularly in a volatile market.

-

Succession Planning: As Buffett slows down at 94, the spotlight will be on Greg Abel, who is expected to take the reins eventually. His role in the meeting will be closely watched as stakeholders assess the future leadership of Berkshire Hathaway.

- Investment Strategies: Given the current market volatility, Buffett will likely face questions about his investment plans, particularly regarding whether he favors U.S. Treasuries or remains optimistic about stocks.

Berkshire Hathaway continues to be a leading indicator for the health of the American economy, and the upcoming meeting promises to deliver crucial insights as investors prepare for the year ahead. For more information and updates, visit Berkshire Hathaway’s official site and stay tuned for the live coverage on CNBC.